Florida’s insurance crisis has left Ron DeSantis dumbfounded. But someone else has a bold idea.

The second of five big questions facing Florida lawmakers as they gavel open the 2024 legislative session.

This is Seeking Rents, a newsletter and podcast devoted to producing original journalism — and lifting up the journalism of others — that examines the many ways that businesses influence public policy across Florida, written by Jason Garcia. Seeking Rents is free to all. But please consider a voluntary paid subscription, if you can afford one, to help support our work.

With Florida’s Republican-controlled Legislature set to begin its 2024 session on Tuesday, Seeking Rents has pulled together five important questions that lawmakers will answer over the next 60 days.

Question 1 posted earlier today: Just how much money can one group of politicians take from the poor — and give to the rich — in two months?

Now, let’s turn to Question 2, which centers on what is, for many Floridians, the single biggest problem facing the state right now:

Will Florida lawmakers do anything to make property insurance more affordable?

When Gov. Ron DeSantis unveiled his proposed budget last month, one of the very first things he mentioned was a plan to cut the cost of homeowner’s insurance in Florida by slashing taxes on insurance companies. His staff claimed it would save the average Florida homeowner 6 percent on their premium.

That was, it turns out, not true. DeSantis’ plan, which was recently presented to state economists, would probably save the average homeowner less than 4 percent.

It’s not clear if Team DeSantis was exaggerating or simply mistaken. Both I and Orlando Sentinel columnist Scott Maxwell tried repeatedly to get a good-faith explanation from the governor’s office, but his press secretary and budget director were unwilling to — or perhaps incapable of — answering with any depth. (DeSantis’ budget director did delete a Tweet promising 6 percent savings, though.)

On one level, this might seem like nitpicking — even a 6 percent savings would be a pittance in a state where average premiums have more than doubled since DeSantis took office in 2019.

But it’s emblematic of a larger problem with — and for — Ron DeSantis: He seems to be utterly out of ideas on property insurance, even as it remains the most pressing financial problem in Florida right now.

It’s now been more than a year since the governor called a special session and gave the insurance industry nearly everything it wanted — including sweeping new protections from civil lawsuits and changes that make it harder for Floridians to seek refuge in the state’s own property insurance company. And yet, property insurance prices continue to soar, while DeSantis careens from blaming the crisis on a culture-war boogeyman to advising Florida homeowners to “knock on wood.”

But while DeSantis appears to be out of ideas on insurance, some Florida lawmakers are not. One in particular has proposed something truly dramatic: Turning state-run Citizens Property Insurance Corp. into a genuine public option, open to anyone in Florida in need of hurricane insurance.

The idea is that Florida itself would ultimately provide all windstorm insurance coverage for its residents, while the private sector continues to cover fire and theft and everything else on a typical homeowner’s policy.

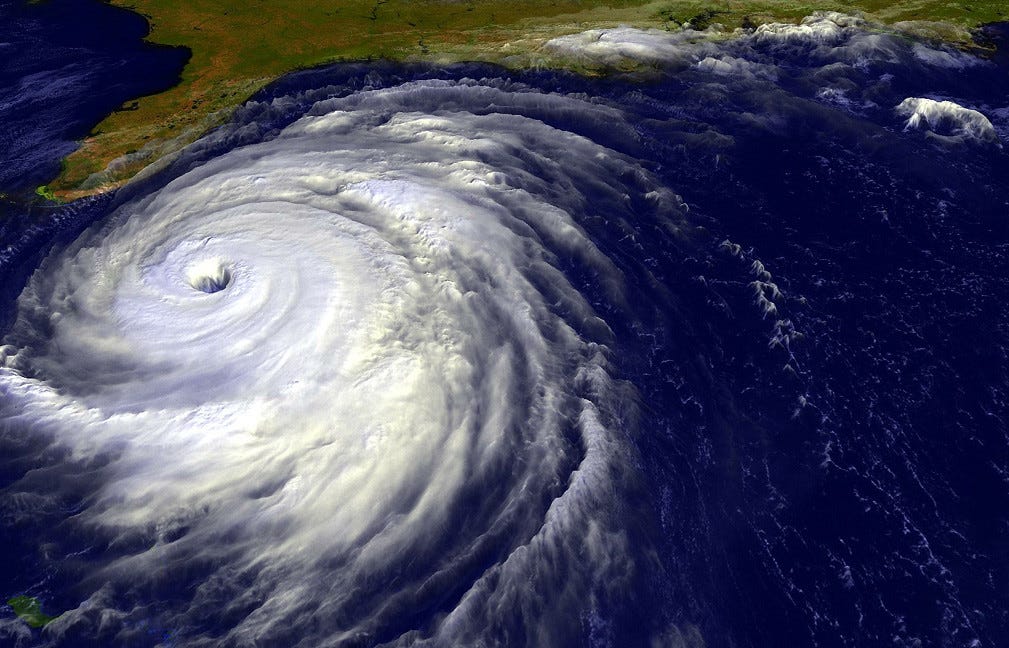

The legislation (House Bill 1213) comes not from a Democrat but from Rep. Spencer Roach, a Republican from North Fort Myers. Roach represents a part of Florida still rebuilding from Hurricane Ian, the monstrously big storm that killed 150 people and caused more than $112 billion in damage in September 2022.

“Florida will eventually and inevitably have to embrace the idea of universal windstorm coverage,” Roach said. “The current model is unsustainable and will eventually collapse, much like California’s market did after the Northridge Earthquake of 1994.”

“The whole idea is to take the risk of insuring against hurricane-related wind OUT of the equation for the private market,” Roach added. “Rates will drop like a stone.

This is not a new idea. But the Florida Legislature has refused to seriously consider it in the past.

That has to change. This might just be the most important bill of the entire session.

Too late for many that dropped the wind coverage. Their rates still rose.

tried repeatedly to get a good-faith explanation from the governor’s office,---- you are spitting into the wind