Banks lobbyists want to slash funding for legal support programs

With Florida's 2025 legislative approaching, banks have begun a campaign to cut funding for legal programs that help veterans, domestic violence victims, and families facing eviction and foreclosure.

This is Seeking Rents, a newsletter and podcast devoted to producing original journalism — and lifting up the work of others — about Florida politics, with an emphasis on the ways that big businesses and other special interests influence public policy in the state. Seeking Rents is produced by veteran investigative journalist Jason Garcia, and it is free to all. But please consider a voluntary paid subscription, if you can afford one, to help support our work. And check out our video channel, too.

As Florida lawmakers prepare for their next legislative session, the banking industry is lobbying to cut funding for legal programs that support veterans, victims of domestic violence, and families facing eviction and foreclosure.

Just days after the end of the 2024 elections, records show a group of banks hired two lobbying firms in Tallahassee to push for the cuts when Florida’s Republican-controlled Legislature convenes early next year for the 2025 session.

The bank lobby’s target: Legal aid, a long-running program designed to keep courts fair and open to all — and to stop the judicial system from becoming a weapon for the wealthy to wield against everyone else.

Now, the backstory here is a bit convoluted. But it’s worth taking some time to understand it, because this could become a big issue during the 60-day legislative session, which will begin in March — and it’s too important to let slip through the state Capitol without scrutiny.

And let’s start with three overarching points that I think everybody would agree with:

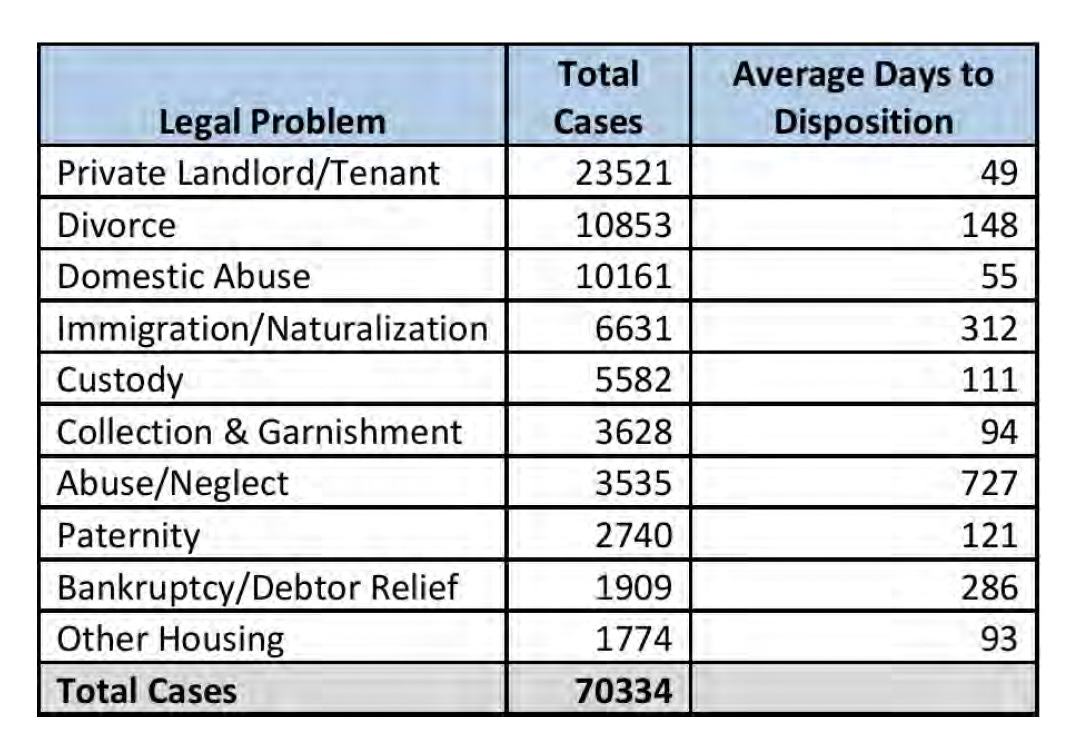

First: Legal aid programs are critical. They typically serve folks earning no more than 200 percent of the federal poverty level — about $62,000 a year for family of four. And they do so in cases of life-changing consequences: Battered spouses attempting to divorce abusive partners and maintain custody of their children; disabled veterans trying to get the benefits they are owed; families about to have their homes seized by a bank.

Second: There is enormous unmet need in Florida, a state where more than one in eight people lives in poverty. A December 2022 report from the Florida Bar found that legal aid programs across the state employed about 500 lawyers combined. That’s about 0.5 percent of all lawyers admitted to practice law in Florida — and yet they are supposed to serve about 20 percent of the state’s population.

And third: Legal aid in Florida has been badly underfunded for years. That’s partly because Florida is one of just four states in the country — along with Alabama, Arizona and Idaho — that does not fund legal aid directly, according to the most recent survey from the American Bar Association.

Instead, the primary source of funding for legal aid in Florida is a program created by the Florida Supreme Court known as “IOTA.” It stands for “interest on trust accounts.”

Here’s how it works:

Law firms frequently hold small or short-term funds on behalf of clients — like, for instance, money placed into escrow during a real-estate transaction. Under the IOTA program, firms must put all of those funds into a single, interest-bearing bank account. The interest earned on those accounts is used to fund legal aid programs.

This has become a big line of business for the banking industry. Banks, credit unions and other financial institutions are collectively holding more than $9 billion worth of IOTA deposits, according to Funding Florida Legal Aid, a foundation affiliated with the Florida Bar that oversees the IOTA program.

The Florida Supreme Court used to require law firms to seek out the highest available interest rates when choosing which banks to use for their IOTA business. But the rules were vague and weak, and many firms ended up parking their accounts at banks paying paltry rates.

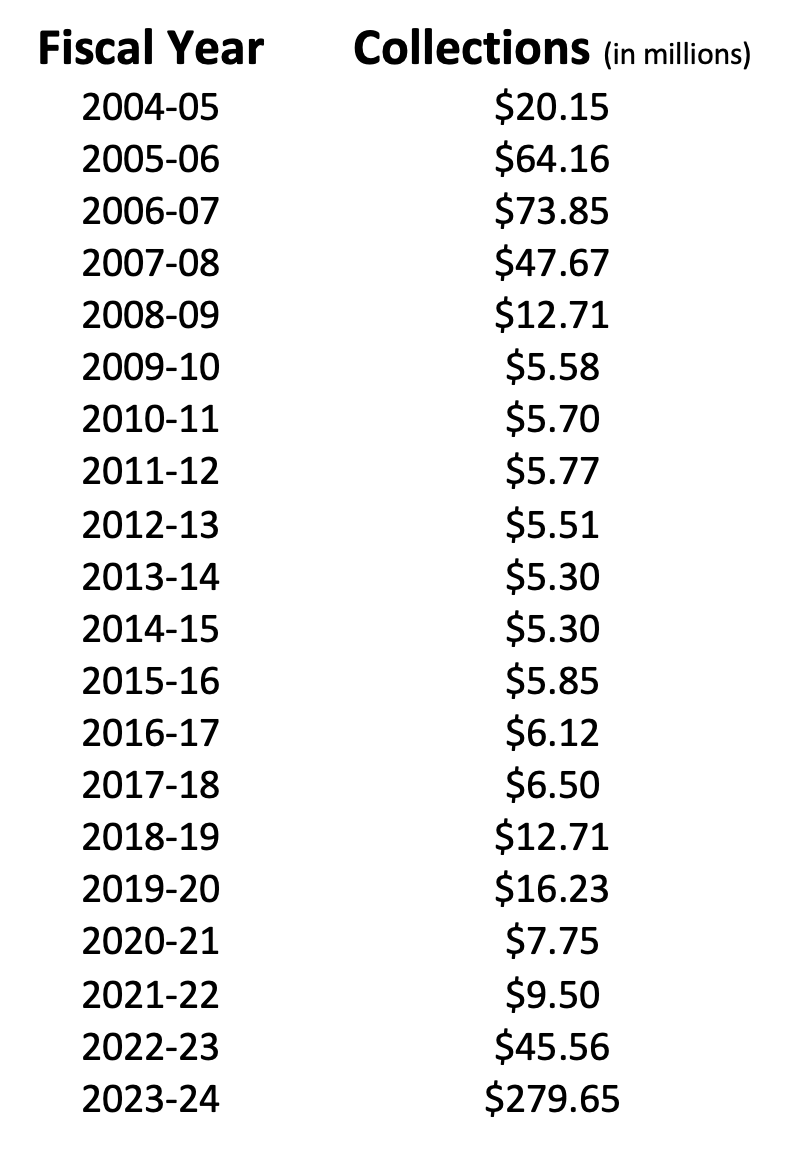

Consider this: Between 2009 and 2022, banks paid less than $8 million a year on average in IOTA interest, according to data from Funding Florida Legal Aid — on billions of dollars of dollars in deposits. Some accounts were earning as little as 0.1 percent.

But things changed in March 2023. That’s when the Supreme Court approved new rules that effectively required any bank wishing to hold IOTA deposits to pay substantially higher interest rates.

The effect was immediate — and dramatic. Between 2022 and 2024, IOTA collections skyrocketed from just under $10 million to roughly $280 million. (That’s not solely due to new rules; it’s also partly because of higher interest rates imposed by the Federal Reserve as it tried to slow inflation.)

This new money is only beginning to make its way to legal aid programs across the state. But the impact is already profound.

The number of attorneys and paralegals working at legal aid firms has already jumped by nearly 20 percent, according to Funding Florida Legal Aid. And these firms are serving more clients — while turning fewer people away for a lack of resources.

Funding Florida Legal Ad has also set aside a bunch of the new money in reserves that are meant to smooth out the impact of future interest rate fluctuations — and also to give legal aid programs time to responsibly scale up their operations.

This is, from most vantage points, great news. Like I said at the top, legal aid is important; there’s lots of unmet demand; and it has been badly underfunded for years.

And this stuff really matters. Veterans are far more likely to get disability benefits when they have an attorney helping them file claims. Renters are far less likely to get evicted when they have a lawyer looking out for their interests.

But some banks are furious about having to pay for it.

One publicly traded bank — Stuart-based Seacoast Banking Corp. of Florida— blamed the new IOTA rules for eating into its profits last year. (Seacoast still managed to turn a profit of more than $100 million.)

Banking industry lobbyists tried to muscle a bill through Tallahassee during the 2024 legislative session that would have slashed IOTA interest rates. They also tried asking the Florida Supreme Court to reconsider the new rules.

They even called in favors from industry-friendly politicians — like Chief Financial Officer Jimmy Patronis, who is now running to replace U.S. Rep. Matt Gaetz in Congress.

The 2024 legislation failed to pass, and the court would not change its mind.

But now round three is about to begin.

In November, a new group called “Banks for a Sustainable IOTA Program” hired a pair of lobbying firms to take up the cause during the 2025 session. They are already working the issue in the Capitol.

It’s not clear what specific banks are behind the group. But it is based out of a post office in Sarasota. That’s also the home of Gulfside Bank, whose chief executive has been a leading critic of the IOTA rule changes.

Gulfside also holds roughly $30 million in IOTA deposits — about 10 percent of its total assets — according to testimony CEO Dennis Murphy gave to a Senate committee last year.

Scott Jenkins, one of the lobbyists hired by Banks for a Sustainable IOTA Program, wouldn’t say what specific changes the banks want lawmakers to make. “We are in current discussions with the Florida Bar to see if a compromise can be formulated,” he said.

The banks claim the new rules force them to pay artificially high interest rates. They say the rules require them to give the kinds of interest rates to IOTA account holders that banks normally reserve for low-transaction, stable-balance savings accounts — even though they say some IOTA accounts function more like checking accounts with lots of transactions and fluctuating balances.

The thing is, nobody is forcing banks to do a thing here. Banks aren’t required to participate in the IOTA program. They don’t have to hold an IOTA account if they don’t think it’s profitable.

And they keep crying wolf. From the moment the new rules went into effect in March 2023, banking lobbyists have been claiming that the new interest rate rules would drive many banks out of the IOTA business altogether.

The higher interest rates will have a “a disproportionate negative effect by causing an abrupt and destabilizing decline in the number of participating banks, resulting in decreased choice for, and significant cost-shifting to, Florida law firms,” the Florida Bankers Association warned the Supreme Court in March 2023.

The opposite has happened. The number of banks participating in the IOTA program has grown from 163 when the rules were changed to 170 now, according to Funding Florida Legal Aid.

Even Seacoast, the bank that complained about IOTA accounts becoming less profitable, has told its investors that it doesn’t plan to leave the business.

“I know one of the sticking points recently has been the IOTA cost,” a stock analyst asked Seacoast Chairman and CEO Chuck Shaffer on a company earnings call earlier this year. ”So you’re not sort of managing that vertical away, just given that increased cost due to IOTA?”

“No, we’re definitely still in the vertical,” Schaffer responded. “We like the business. Just paying more interest expense for it.”

Thanks for this information. I never cease to be amazed at how little the “wealthy” and “well connected” feel the need to contribute to a functioning society. This state seems to have a higher than average number of people who have no regards for anyone not in the absolute top wealth bracket.

Great article. Legal aid programs definitely need to weigh in on this!