Central Florida leaders are about to abuse a state law to help a big developer

Exploiting parts of a law meant to help struggling communities, Osceola County commissioners will vote Monday on a plan that will steer millions to a housing development by The Tavistock Group.

This is Seeking Rents, a newsletter and podcast devoted to producing original journalism — and lifting up the journalism of others — that examines the many ways that businesses influence public policy across Florida, written by Jason Garcia. Seeking Rents is free to all. But please consider a voluntary paid subscription, if you can afford one, to help support our work.

Local leaders in a central Florida county are about to abuse a state tax law in order to subsidize one of the state’s biggest and wealthiest developers.

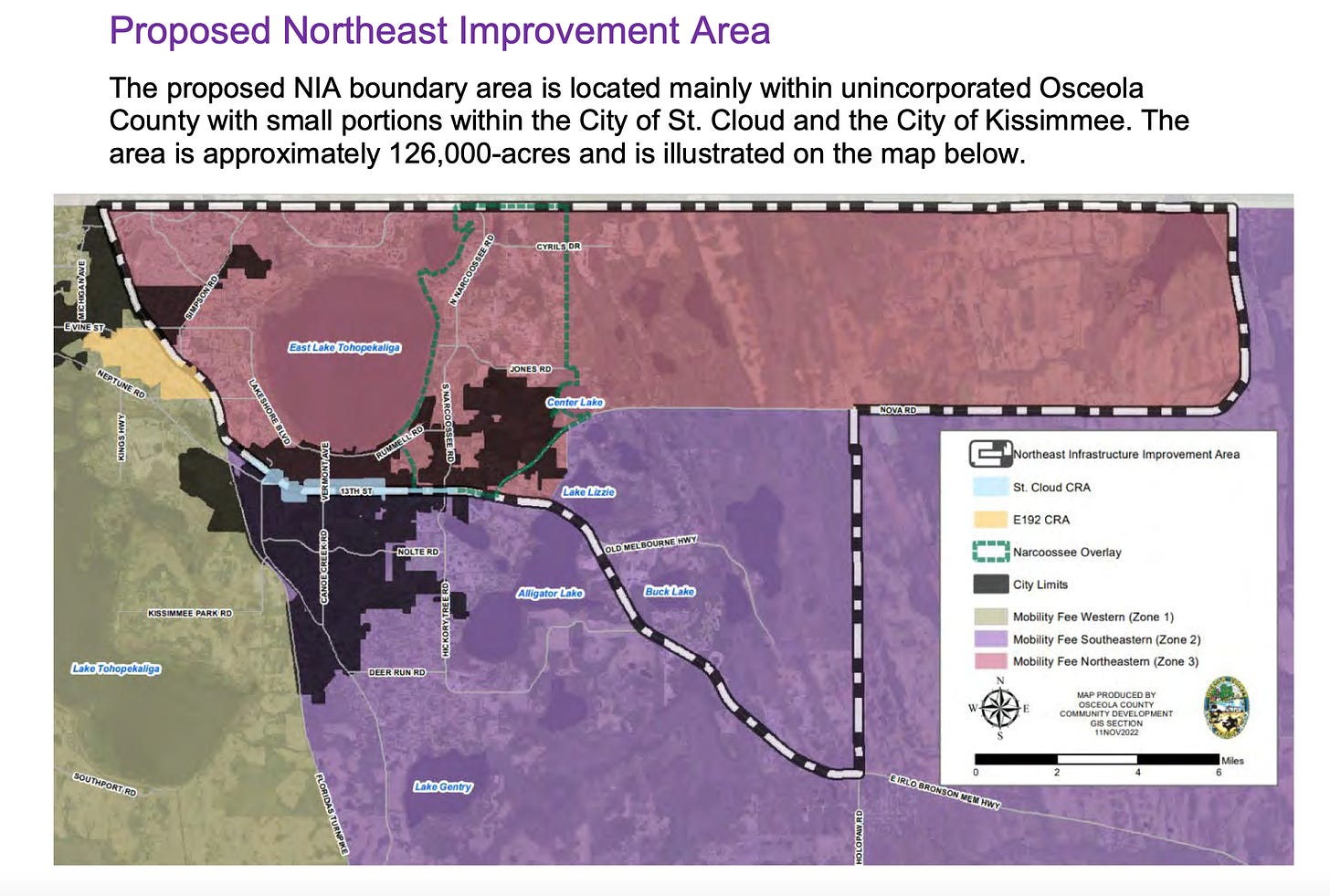

On Monday, during a board meeting that’ll be held less than a week before Christmas, commissioners in Osceola County are expected to vote on a plan to set up a new taxing district over nearly 130,000 acres of land southeast of Orlando.

Osceola County is creating this tax district by relying, in part, on a decades-old state law that was originally designed to steer extra resources into poor communities struggling with “slum and blight.”

But Osceola County won’t use this tax district to help some decaying urban core or forgotten rural outpost. Instead, Osceola will use it to steer millions of dollars into a sprawling new housing development being built by The Tavistock Group — the real-estate firm owned by billionaire investor Joe Lewis that also built Orlando’s Lake Nona community.

This plan was exposed last week by Natalia Jaramillo of the Orlando Sentinel.

Osceola and Tavistock are exploiting provisions in a state law known as the “Community Redevelopment Act,” and they’re the latest in a long line of local politicians and big businesses to do it. Universal Orlando and other tourism interests have been playing a similar game for years, too — enabled by elected leaders at both Orange County and the city of Orlando.

Here’s what they’ve done:

Last week, Osceola commissioners approved a resolution declaring that 126,627 acres of land in the northeastern part of the county — much of which is still undeveloped — has become “blighted.” Osceola leaders based this claim on the fact that the region, which Osceola has dubbed the “Northeast Improvement Area,” needs some better roads and sidewalks.

After designating this area as blighted, Osceola County is now setting up the special taxing district.

This tax district will be used to shift property taxes out of Osceola County’s general fund, where commissioners would normally be free to spend the money on important community needs anywhere in the county.

Instead, that tax revenue will be set aside in a separate account — and commissioners will be forced to spend it solely on transportation projects within this Northeast Improvement Area.

Why would Osceola County leaders want to handcuff themselves like this?

To help Tavistock, the politically influential real-estate developer with a preternatural talent for snagging tax subsidies from local governments.

The northeastern part of Osceola County is where Tavistock is building a nearly 40-square-mile community called “Sunbridge,” a city-sized subdivision that will eventually have more than 30,000 homes and apartments.

Tavistock executives had already persuaded Osceola County officials to commit to spending more than quarter of a billion dollars building new roads in and around Sunbridge — vital infrastructure that Tavistock needs if Sunbridge is to be successful.

This new tax district is how Osceola County plans to pay most of that that tab.

Altogether, records show that Osceola County expects to use this tax district to pull roughly $160 million out of its general fund in the coming years to help pay for all those new Tavistock roads. (The county will pay for the rest of the bill with revenue from mobility fees.)

Of course, that’s $160 million that then won’t be available to pay for any other road projects — or parks or police or public health — anywhere else in Osceola County.

Clarification: An earlier version of this story gave the impression that Osceola County had created a Community Redevelopment Association, a type of tax-increment district authorized under the Community Redevelopment Act. The county actually set up a different kind of tax-increment district authorized under another section of state law. But Osceola County is using parts of the Community Redevelopment Act as legal cover — including its claim that this new tax district will rehabilitate “slum and blight.”

After reading the article by Natalia Jaramillo of the Orlando Sentinel (mentioned in this article), the "special taxing district" in this article is not a Community Redevelopment Agency (CRA), created by the Florida Redevelopment Act of 1969. It is a Community Development District (CDD), which, unlike a CRA, is a "special taxing district", that, unlike CRAs, spends tax dollars to make improvements to the district it overlays. Please learn more about CDDs at https://www.cfmcdd.org/questions/.

To be honest, CRAs have their issues. But it is because of poorly written articles like this that CRAs find themselves being targeted by the Florida Legislature. CRAs do address slum and blighted areas, housing, and crime. Articles like this do not help their cause. Consider correcting or removing the article, thank you.

That totally sucks!

Who on the county commission is getting the inevitable kickback on this deal?

Clever of them to push this through when everybody is deep into the holidays and family and has no energy to attend to this bullshit!

Does no one care that $ is needed to subsidize housing for the people who are presently getting their rents hiked which is displacing them with no where to go?

This kind of ‘development I can guarantee is not helping anyone who needs the help...only the developers.

Same kind of BS up here in North Florida where so many people are now homeless as a result!