Did Ron DeSantis try to get Disney a tax break?

Emails show a top DeSantis aide worked on a proposed tax break that could have saved the Walt Disney Co. tens of millions of dollars.

This is Seeking Rents, a newsletter and podcast devoted to producing original journalism — and lifting up the journalism of others — that examines the many ways that businesses influence public policy across Florida, written by Jason Garcia. Seeking Rents is free to all. But please consider a voluntary paid subscription, if you can afford one, to help support our work.

Over the last couple of years, a proposed tax break has been floating around the Florida Legislature that could save tens of millions of dollars for a prominent corporation: The Walt Disney Co.

And it turns out a prominent politician has been involved with that proposed tax break: Florida Gov. Ron DeSantis.

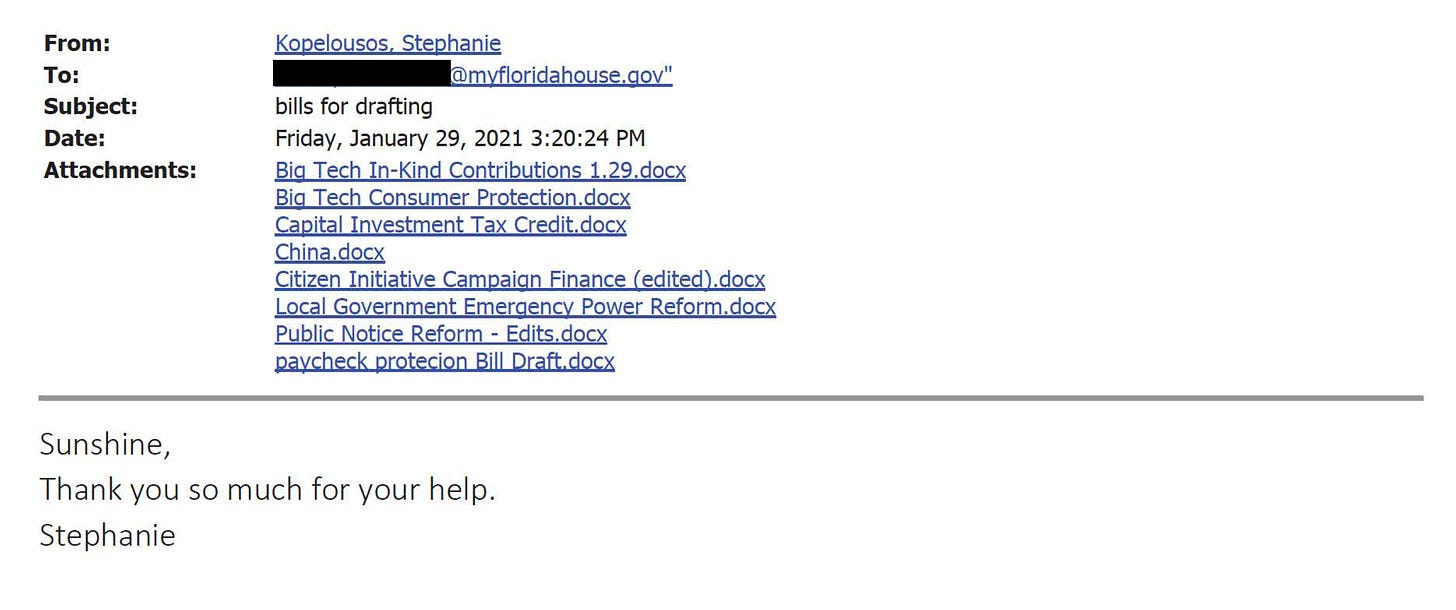

That’s according to emails that turned up in a public-records request, which show that one of DeSantis’ top aides worked on a draft of the potential Disney tax break in January 2021, in the weeks leading up to that year’s legislative session.

Now, these emails which were produced in response to a larger records request made by veteran Capitol reporter Gary Fineout of Politico Florida, don’t provide much detail or context.

For instance, they don’t reveal anything about how hard DeSantis’ office pushed for the tax break, which ultimately failed to pass in 2021. And they don’t show whether DeSantis or his staff continued to work on the idea during the 2022 session, when it was filed again, or whether the governor continues to support the concept now.

The Governor’s Office declined to answer any questions about its work on the proposal.

But as Florida prepares for a 2023 legislative session that will attract a lot of national attention ahead of DeSantis’ probable presidential campaign, it’s yet another reminder that there are two kinds of Ron DeSantis issues.

There are the issues that he champions openly and aggressively, like his efforts to regulate social media companies or restrict discussion of race in school classrooms and corporate training programs. And then there are the other things that he quietly works on behind the scenes and never breathes a word about in public.

A tax break for Electronic Arts becomes a tax break for Disney

This potential Disney tax break has a very interesting backstory, even aside from DeSantis’ role in it.

It first surfaced in April 2019, midway through that year’s legislative session, in an amendment to another tax bill proposed by Sen. Joe Gruters, a Republican from Sarasota who doubles as the chairperson of the Republican Party of Florida.

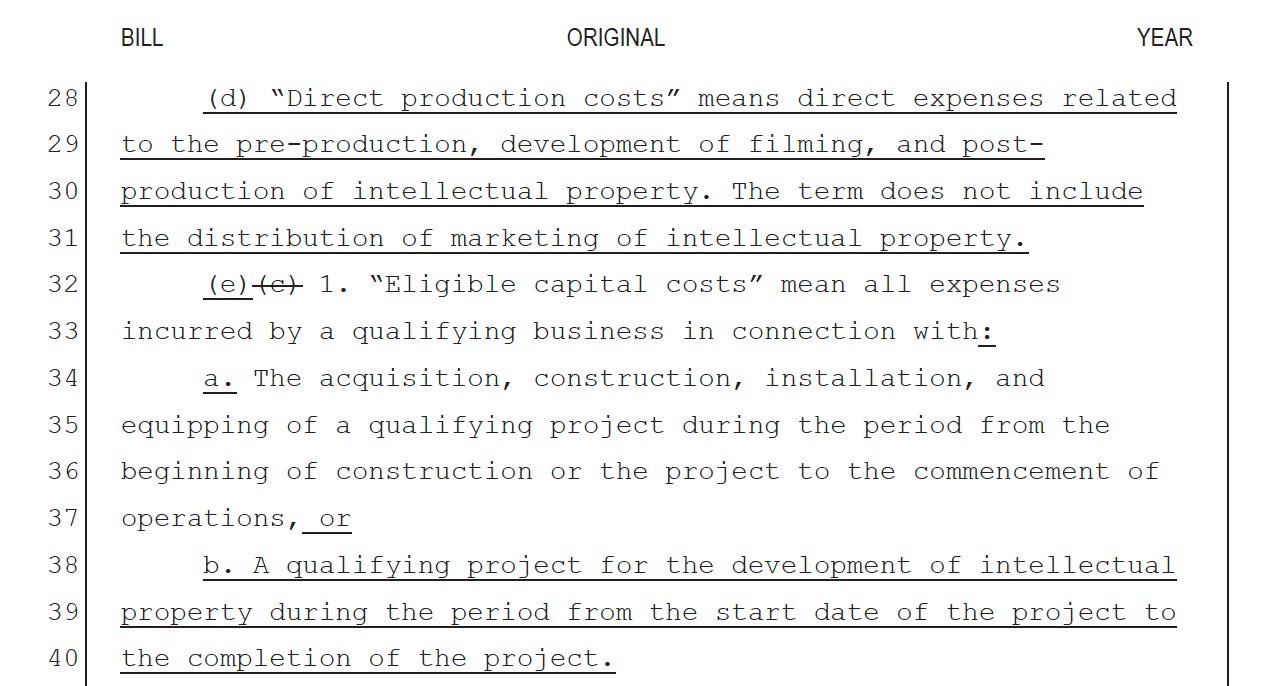

Gruters’ proposal called for expanding one of Florida’s most lucrative corporate incentive programs — the Capital Investment Tax Credit, or CITC — to include companies that invest in “intellectual property” projects. And by “intellectual property,” the legislation really meant “video games.”

Gruters initially suggested to his fellow senators that this tax break was somehow supposed to help the state’s universities. (Seriously, he said that.) But he later admitted in response to questions from a reporter that he’d gotten the idea from the Entertainment Software Association, a lobbying group for big video-game developers like Electronic Arts — which makes sports video games at an office in Orlando.

This “intellectual property” tax break failed to pass in 2019. It failed again during the 2020 session, when Gruters tried a second time.

But then a new version of the proposed tax break surfaced just before the start of the 2021 session. That’s right around the time that the emails unearthed through Fineout’s public-records request show that DeSantis’ aides were working on the idea.

Specifically, the emails show that Stephanie Kopelousos, the governor’s legislative affairs director, sent drafts of the proposed “intellectual property” tax break to staffers in both the state House and the Senate in late January 2021. That was about two weeks before Gruters filed the bill for the third time.

This new version of the bill expanded the proposed tax break beyond video games to cover film and television productions, too. And it quickly drew the support of some powerful new supporters: Disney and Comcast Corp., the parent company of NBCUniversal, and front groups they help fund, like Associated Industries of Florida and the Florida Chamber of Commerce.

The proposal also picked up its first sponsor in the state House of Representatives: Former Rep. Jason Fischer, a Republican from Jacksonville who was one of DeSantis’ most loyal supporters in the Legislature.

In fact, this tax break might finally have passed in 2021 had it not been for one little (well, giant) snag: The panel of state economists who “score” every proposed tax break for its potential impact on the state budget determined that this one was so vaguely written that it could have ended up costing the state of Florida more than $1 billion a year.

The enormous price tag essentially doomed the bill in the Legislature. Gruters and Disney tried again last year, but the idea failed once more.

Why would DeSantis help Disney?

Like I said earlier, the Governor’s Office declined to answer any questions about its role in this legislation. Neither Gruters nor Fischer would say anything about DeSantis’ involvement, either.

But I have a theory about what happened:

You might recall that Disney announced in July 2021 that it was going to move roughly 2,000 jobs to Orlando from its corporate offices in California. That announcement came after the company negotiated an incentive package with the DeSantis administration — which included a potential $570 million award through the state’s Capital Investment Tax Credit program.

It certainly seems plausible that, during those incentive negotiations, Disney and the DeSantis administration discussed ways to get the Florida Legislature to expand the CITC program so that Disney could qualify for an even bigger tax break. And maybe they decided to use Gruters and Electronic Arts’ proposed “intellectual property” concept as the vehicle to do it. But the effort failed because it would have blown a billion-dollar hole in the state budget.

Remember: We know the DeSantis administration was being very attentive to Disney at this point in time. During the 2021 session, DeSantis’ office also helped Disney get a last-minute carveout from a bill the governor was pushing to “crack down” on alleged censorship by social-media companies like Facebook and Twitter. (And then there’s the fact that Disney gave DeSantis a $50,000 donation midway through the 2021 session.)

But this is, admittedly, pure speculation. Obviously, DeSantis’ staff could answer questions about why they were working on this potential tax break for Disney. But they chose not to.

It’s possible this tax break could come back yet again during the 2023 session, which starts in March.

But if it does, it’s probably safe to assume that DeSantis won’t try to help Disney out again.