Florida chafes under flood-protection rules

Florida in Five: Five stories to read from the past week in Florida politics.

This is Seeking Rents, a newsletter and podcast devoted to producing original journalism — and lifting up the work of others — about Florida politics, with an emphasis on the ways that big businesses and other special interests influence public policy in the state. Seeking Rents is produced by veteran investigative journalist Jason Garcia, and it is free to all. But please consider a voluntary paid subscription, if you can afford one, to help support our work. And check out our video channel, too.

Welcome to another installment of Florida in Five: Five* stories you need to read from the past week in Florida politics.

There’s another difficult insurance debate coming to the Florida Capitol.

It involves flood insurance, and something known as the “50 percent rule.”

To quickly explain: Homeowners who live in flood-prone parts of the country buy publicly subsidized insurance through the national flood insurance program. Many of these homeowners live in older homes built under weaker builder codes that would be utterly uninsurable on the private market. They can only live where they do because federal taxpayers ultimately cover their exposure.

The flood insurance program is managed by the Federal Emergency Management Agency. And to make sure that taxpayers don’t end up subsidizing the reconstruction of vulnerable homes that will inevitably flood again, FEMA has a rule: If a home in a flood zone suffers damage worth more than half of its value, that home cannot be repaired. It must be torn down and rebuilt to modern flood-safety standards.

This is the 50 percent rule. And it can be the difference between whether a family returns to their home after a hurricane — or they must move away forever. Rebuilding might mean, for instance, taking a home that was originally built upon a simple concrete slab and raising it up 10 feet or more on stilts. That’s simply too expensive for many homeowners, particularly since flood insurance coverage is capped at $250,000.

It also means that — at least on an individual level — homeowners have a lot of incentive to dodge the 50 percent rule, if they can. And one way to do that is by splitting a repair job up into a series of smaller projects, none of which reach the 50 percent threshold by themselves but which collectively violate the rule.

To plug that potential loophole, FEMA encourages communities to adopt something known as a “lookback period.”

In a city with a one-year lookback period, for instance, any renovations or repairs that a homeowner makes over the course of a year will count towards the 50 percent rule. That can stop a homeowner from evading the rule and using taxpayer resources to rebuild a home that is just going to flood again in a few years. FEMA rewards communities that adopt lookbacks by discounting the price of flood insurance for everyone in the area.

But lookbacks come with their own consequences.

(“Quickly explain,” he said.)

They can be confusing and frustrating, especially for homeowners who are unexpectedly denied a building permit for a project. They dissuade some people from making renovations that would raise the value of their homes and their surrounding neighborhoods. They may even stop someone from hardening their homes against future hurricanes.

Last year, after extensive flooding along Florida’s west coast from Hurricanes Ian (2022) and Idalia (2023), state lawmakers put $500,000 into the state budget for a study on lookback periods. That study came back last month. And some of the findings were striking.

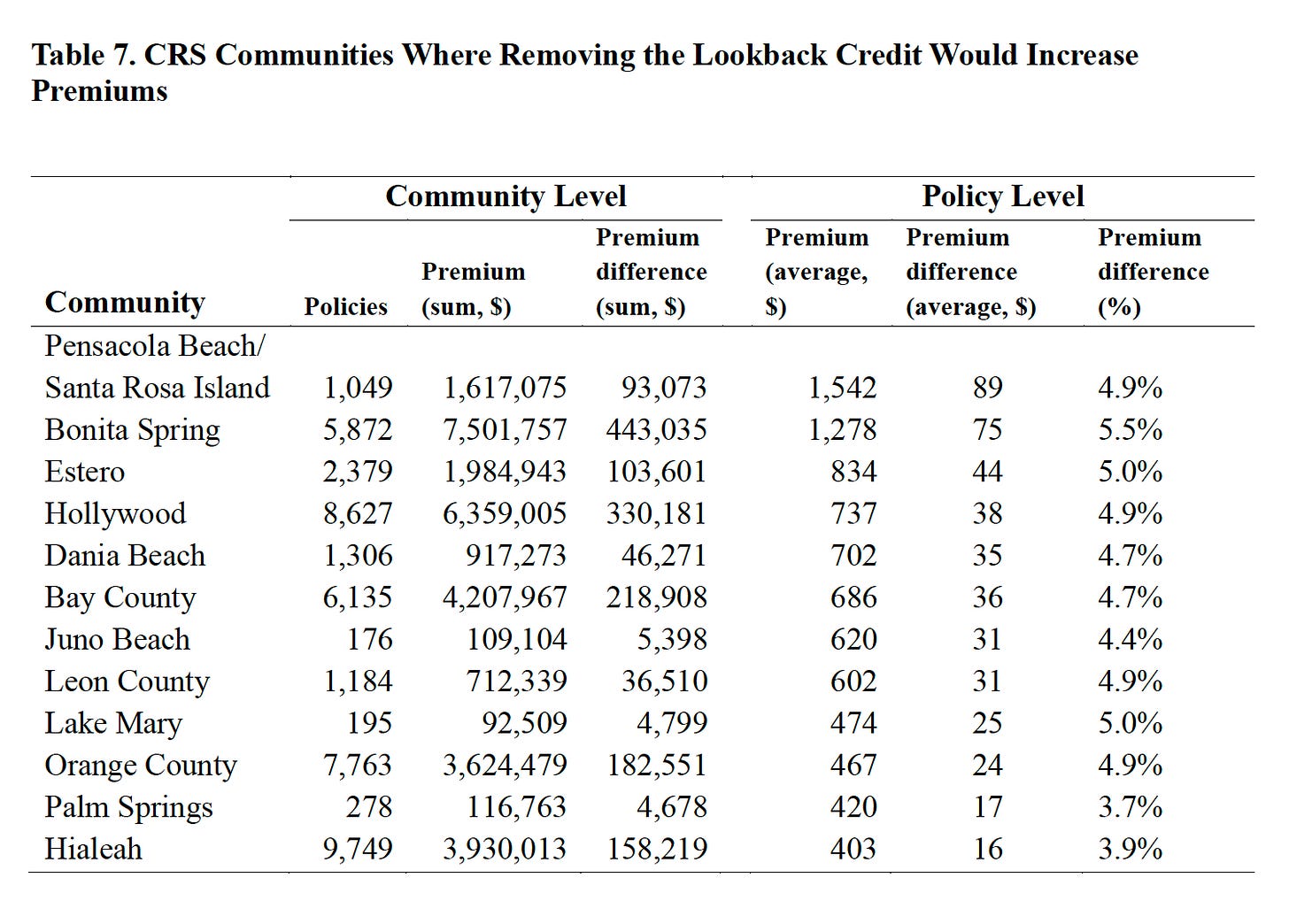

Researchers at Florida State University found that more than 100 cities and counties across the state have adopted lookback periods. But fewer than half of those communities are actually getting corresponding discounts on their flood insurance. And the savings are relatively small in the communities that are receiving discounts — no more than 5.5 percent.

The FSU researchers also found that the length of lookback periods vary wildly, from one or two years in some communities to 10 or more in others. And perhaps most significantly, they found evidence that longer lookback periods constrain renovation activity and suppress home values.

Already one lawmaker — Republican state Rep. Linda Chaney, who represents flood-prone Pinellas County — has said she will sponsor a bill during the 2025 legislative session to stop cities and counties from setting long lookback periods.

Some changes may be warranted. And they will surely be popular in places still struggling to rebuild not only from Ian and Idalia but also this year’s Hurricanes Helene and Milton.

But there’s also a tradeoff here. Because making it easier for flooded communities to rebuild exactly the way they were before a storm adds to the moral hazard inherent in flood insurance — a hazard that keeps getting worse as the planet warms and the oceans rise.

*To paraphrase Barbossa, five is more what you’d call a guideline than an actual rule.

Topics to watch in 2025: Everglades and phosphogsypum

In Florida, a race is on to save the Everglades and protect a key source of drinking water (Associated Press)

See also: EPA backs controversial pilot project to use radioactive material in Florida road project (Orlando Sentinel) ($)

Peeling an onion

The behind-the-scenes story of the Florida state park scandal (Tampa Bay Time) ($)

Happy New Year

Tampa Electric rate hikes will officially start in January (Tampa Bay Times) ($)

Unnecessary cruelty

10 Million Kids at Risk of Hunger Unless GOP-Led States Embrace Summer EBT Program (Common Dreams)

See also: DeSantis admin mum ahead of Jan. 1 deadline for summer food program for kids (Florida Phoenix)

Always read Mike Grunwald

Sorry, but This Is the Future of Food (New York Times) ($)

See also: You’re being lied to about “ultra-processed” foods (Vox)

Perspectives

Prison for poor addicts. Deals for wealthy crooks. Twisted ‘justice’ (Orlando Sentinel) ($)

Too many of Florida's public school children go hungry. We should feed them. (Palm Beach Post) ($)

Florida’s heat shouldn’t be a workplace killer (Tampa Bay Times) ($)

Curtailing Sex Ed is a Big Mistake (News Service of Florida)

Florida's Voter Intimidation Crisis (League of Women Voters)

I am baffled but no I am not when it comes to Sex Ed. in the classroom and the Republican moral outrage. I went to public school in NY and around 7th grade we got the intro to reproduction in animals. In 11th and 12th grade we took a class in Health and Sexual Education. Oh the horror about learning what a boy and girl could do or moreover, gasp, a man and a woman. Oh the nightmares......Kidding or course. Like most boys running home to look up "Intercourse" and then "Intercourse PA". In this day and age kids have this on their phone and why are we limiting the knowledge. This all comes from the Heritage Foundation and those wackos, "Moms for Virginity". Get a grip, let's talk about it already.