Getting rid of these business tax breaks could bring a bit of relief to Floridians struggling to pay for property insurance

Gov. Ron DeSantis' first attempt to help Floridians with their homeowner's insurance didn't provide nearly enough support. Repealing these old business tax breaks could allow Florida to do more.

This is Seeking Rents, a newsletter and podcast devoted to producing original journalism — and lifting up the journalism of others — that examines the many ways that businesses influence public policy across Florida, written by Jason Garcia. Seeking Rents is free to all. But please consider a voluntary paid subscription, if you can afford one, to help support our work.

If you’re goal is to make sure that home insurance remains available, attainable and adequate in Florida — that is, to make sure Floridians can actually find insurance that they can actually afford and that actually provides enough coverage — then the state of Florida really only has two tools at its disposal, at least in the near term.

One of those tools is Citizens Property Insurance Corp., which sells insurance to homeowners who can’t find affordable insurance on the private market. The other is the Florida Hurricane Catastrophe Fund, which sells insurance to insurance companies — known as “reinsurance” — so that those companies don’t have to buy as much private reinsurance, which drives up the price of the policies they sell to homeowners.

Yes, Citizens and the Cat Fund are both forms of government intrusion into the private sector. But Florida’s already-crumbling private insurance market would collapse entirely without them.

And in an environment when more and more private insurance companies are unwilling or unable to sell affordable policies to many Florida homeowners — and are also unable to find affordable reinsurance for themselves to ensure they can cover the policies that they do sell — you pretty much have to use Citizens and the Cat Fund to help.

Gov. Ron DeSantis already learned this lesson, after he called an emergency session of the Florida Legislature earlier this year to try and stabilize the state’s property insurance market. That session ended with the Republican governor signing an insurance package that used $2 billion of taxpayer money to provide more public reinsurance to private insurers. (Though it used another name, this was, essentially, a temporary expansion of the Cat Fund.)

DeSantis has been attacked since then for “bailing out” insurance companies. That’s because the governor’s insurance plan gave private insurers more help without any guarantee of savings for Floridians.

But the real problem with DeSantis’ insurance plan is that it didn’t go far enough.

Recent reviews of insurance company rate filings by both Standard & Poor’s and the Orlando Sentinel found that DeSantis’ plan prompted insurance companies to seek slightly smaller rate increases than they otherwise would have. But the reinsurance savings passed on to policyholders were tiny — between 1 percent and 3 percent on rates that still jumped by double-digit percentages overall.

This is because DeSantis’ insurance plan was, it turns out, very stingy. Inside P&C, a publication that covers the property and casualty insurance industry, says its sources estimate that DeSantis’ insurance plan provided only about half as much reinsurance support as Florida leaders offered following the hurricanes of 2005 and 2006 — when, coincidentally, Charlie Crist, who is running against DeSantis this fall, was serving as Florida’s governor.

(To underscore just how inadequate DeSantis’ initial insurance plan was: Just two months after he signed it into law, state officials had to scramble to stitch together even more public reinsurance for the private sector.)

It's not clear why DeSantis didn’t do more on the front end. But it’s worth noting that one of the leading opponents of expanding Citizens and the Cat Fund — insurance giant State Farm — is a big donor to the governor, according to Politico Florida.

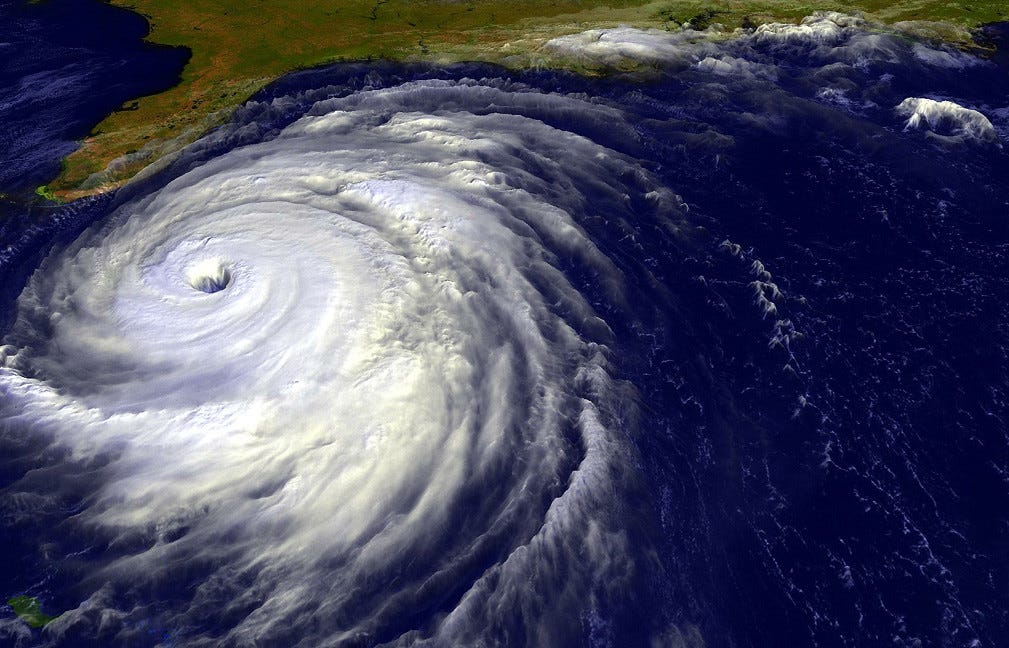

But whatever the governor’s reasons, now that Hurricane Ian has devastated a vast swath of Florida, the state’s property insurance problems are about to get worse. Insurance companies are going to drop more policies entirely and raise rates even higher on the ones they don’t.

If DeSantis (or Crist) are going to help Floridians through this — rather than just helping insurance companies — then they’re going to have to bring the state even deeper into the insurance business through Citizens and the Cat Fund.

Again, this is the only way to offer immediate relief. The other policy options are either poison pills (ie: allowing insurance companies to sell junkier policies that cost more but cover less) or will take a long time and lots of money to achieve results (ie: making it harder to sue insurance companies in order to reduce their litigation costs; hardening homes and infrastructure against storms and floods; and cutting greenhouse gas emissions that contribute to climate change — and hurricanes that intensify more rapidly, push bigger storm surges, and dump more rain).

Now, there’s a pretty obvious downside here.

The more insurance and reinsurance that the state of Florida offers itself, the more claims it will have to pay itself following a major hurricane or a series of storms. And if Citizens or the Cat Fund run out of money to pay those claims, they ultimately make up the shortfall by adding an emergency assessment to virtually everyone’s insurance policies.

People sometimes call it the “hurricane tax.” It’s often invoked as a Boogeyman by lobbyists who are trying to talk Florida’s elected leaders into pushing Floridians out of Citizens or scaling back the Cat Fund — like the Florida Chamber of Commerce, which represents giant insurance companies like State Farm.

Still, the threat of the hurricane tax is real. And it would hit most of us several times over.

For instance, we’d pay this tax on our homeowner’s or renter’s insurance. We’d also pay it on our car insurance. If you own a motorcycle or a boat, you’re going to pay it on that insurance, too. Heck, farmers would even pay the hurricane tax on their crop insurance.

But there’s a way we can ease this potential pain a bit. Because right now not everybody has to pay this hurricane tax.

Specifically, businesses don’t have to pay the tax on their workers’ compensation insurance — thanks to an exemption that was carved into state law 30 years ago.

This carveout dates all the way back to 1993, when Florida lawmakers first created the Cat Fund to stabilize the property insurance market following Hurricane Andrew. At the time, lawmakers were also dealing with problems in the workers’ comp insurance market. So they decided to exempt workers’ comp policies from any future Cat Fund assessments. They later exempted workers’ comp policies from Citizens assessments, too.

If Citizens and Cat Fund assessments are a “hurricane tax,” then this exemption is a hurricane tax break for businesses.

It’s also a tax break that hasn’t been reevaluated in nearly three decades. And Florida’s workers’ comp market looks a lot different today, following a series of changes made during the 1990s and early 2000s that have given businesses in Florida nearly iron-clad protections from lawsuits sparked by on-the-job accidents.

In fact, according to the National Council on Compensation Insurance, which collects and analyzes workers’ comp data, workers’ comp insurance rates in Florida have fallen by more than 70 percent since October 2003 — the last time the Legislature made big changes to workers’ comp law.

Removing the exemption for workers comp insurance would add $4 billion or so to the Citizens and Cat Fund tax base — expanding that tax base from roughly $55 billion to $59 billion, according to data compiled by the Florida Office of Insurance Regulation and the State Board of Administration. That would, in turn, reduce the amount of tax that everyone else would have to pay if Citizens or the Cat Fund get wiped out.

Workers’ comp isn’t the only special-interest exemption, either. Florida lawmakers have also carved doctors out of Citizens or Cat Fund taxes on their medical malpractice insurance policies. Created in 2004, this carveout was initially only supposed to last for three years. But it was later extended and then made permanent.

Removing the hurricane tax break for medical malpractice insurance would add another $700 million to the Citizens and Cat Fund tax base.

To be very clear, eliminating these tax breaks wouldn’t suddenly fix Florida’s flailing property insurance market. But it would help ensure that the burden of Citizens and the Cat Fund is shared more fairly between consumers and businesses.

More importantly, though, it might also make it easier to take on a bit more risk by further expanding Citizens and the Cat Fund.

And that could bring real relief to Floridians.

Truth!!