This is Seeking Rents, a newsletter devoted to producing original journalism — and lifting up the journalism of others — that examines the many ways that businesses influence public policy across Florida, written by Jason Garcia.

Rental-car giant Avis Budget Group Inc. just had the best year in company history, turning a record profit of $1.3 billion.

Now, somebody in the Florida Senate wants to give Avis an extra $5 million.

The Senate has drafted a corporate tax break that would save one or two big rental car companies $5 million each. The companies wouldn’t even have to do anything to qualify for the break – it is the functional equivalent of simply handing them $5 million in cash.

State economists, who analyzed the proposal last week, are certain that at least one company will qualify. And though they didn’t identify that company by name, records show that a lobbyist for Avis helped write the legislation.

But they think there might be one other lucky $5 million winner, too. And that’s likely Avis’ fellow rental-car giant, Enterprise Holdings Inc. – which gave $25,000 just before session began to Sen. Kathleen Passidomo, a Republican from Naples who is the incoming Senate president.

This corporate handout hasn’t been filed as a standalone bill, which would have been heard in open committee hearings and subjected to extended public scrutiny. Instead, it’s waiting behind the scenes as a potential amendment that could surface anytime in the final three weeks of this year’s legislative session, which ends March 11.

Selling cars (but calling them trades)

This is something Avis has been trying to get through the Florida Legislature for four years now. And it’s yet another example of corporations trying to squeeze extra tax breaks out of states following the historic federal tax break they got after former President Donald Trump and the then-Republican-controlled Congress passed the Tax Cuts and Jobs Act in December 2017.

We’ve talked about this before, but to recap: The TCJA gave corporations one of the largest federal income tax cuts in American history. But it also made changes that – because of the way state corporate taxes are linked to federal corporate taxes – led to corporations having to give a portion of their savings back in the form of higher state income taxes. It was still a giant net tax cut overall, because federal corporate taxes are so much larger than state corporate taxes.

One of those changes hit rental-car companies especially hard.

Rental-car companies are pretty much constantly turning over their fleets, selling used cars and buying new ones. And for years, Avis and others have been able to put off paying taxes on the income they earn from all those car sales by treating those sales as if they were just trading old cars for new ones.

But the TCJA put new limits on this tax break (which is sometimes referred to as a “1031 exchange,” after a section of the federal tax code). That meant all those taxes the rental-car companies had been putting off finally came due.

The TCJA also included new tax breaks at the federal level that more than offset the loss of 1031 exchanges. But the new limits led to a big jump in state income taxes.

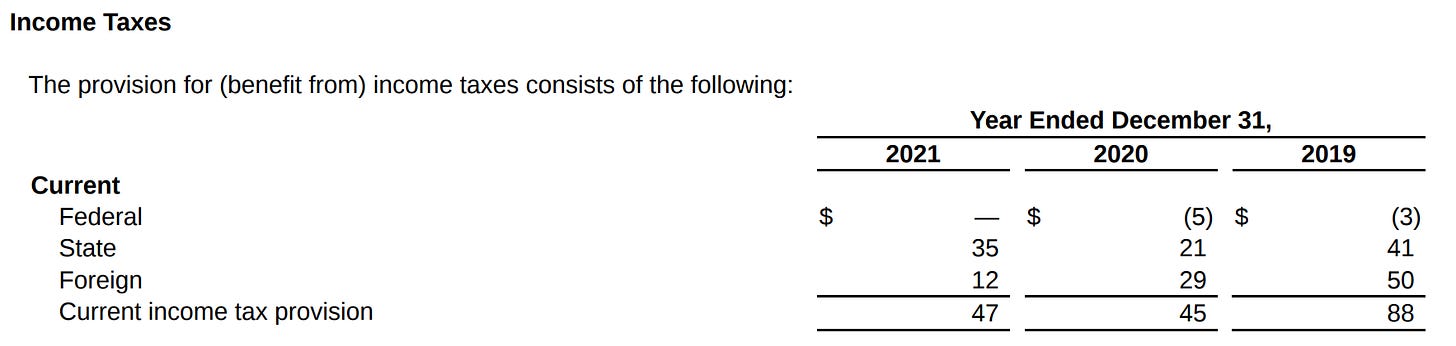

Corporate tax payments are confidential. But Avis has said in the past that its tax bill in Florida, one of the company’s biggest markets, jumped roughly 10-fold in 2018 to more than $15 million.

Sounds like a lot, right? And it is – until you realize that the Tax Cuts and Jobs Act also gave Avis an immediate tax savings of $183 million. And that the company isn’t currently paying anything in federal income taxes, according to its regulatory filings.

Still, the company wants more money from Florida. And some lawmakers apparently want to give it to them.

How the sausage gets made

Avis has been trying to get a tax break from the state since at least 2019. Here’s an email a company lobbyist sent in the middle of the 2019 legislative session to a staffer for the House Ways & Means Committee:

It’s written a bit in code, but the translation is pretty simple. Avis wanted legislation written that would give a $10 million tax credit to a company meeting four conditions:

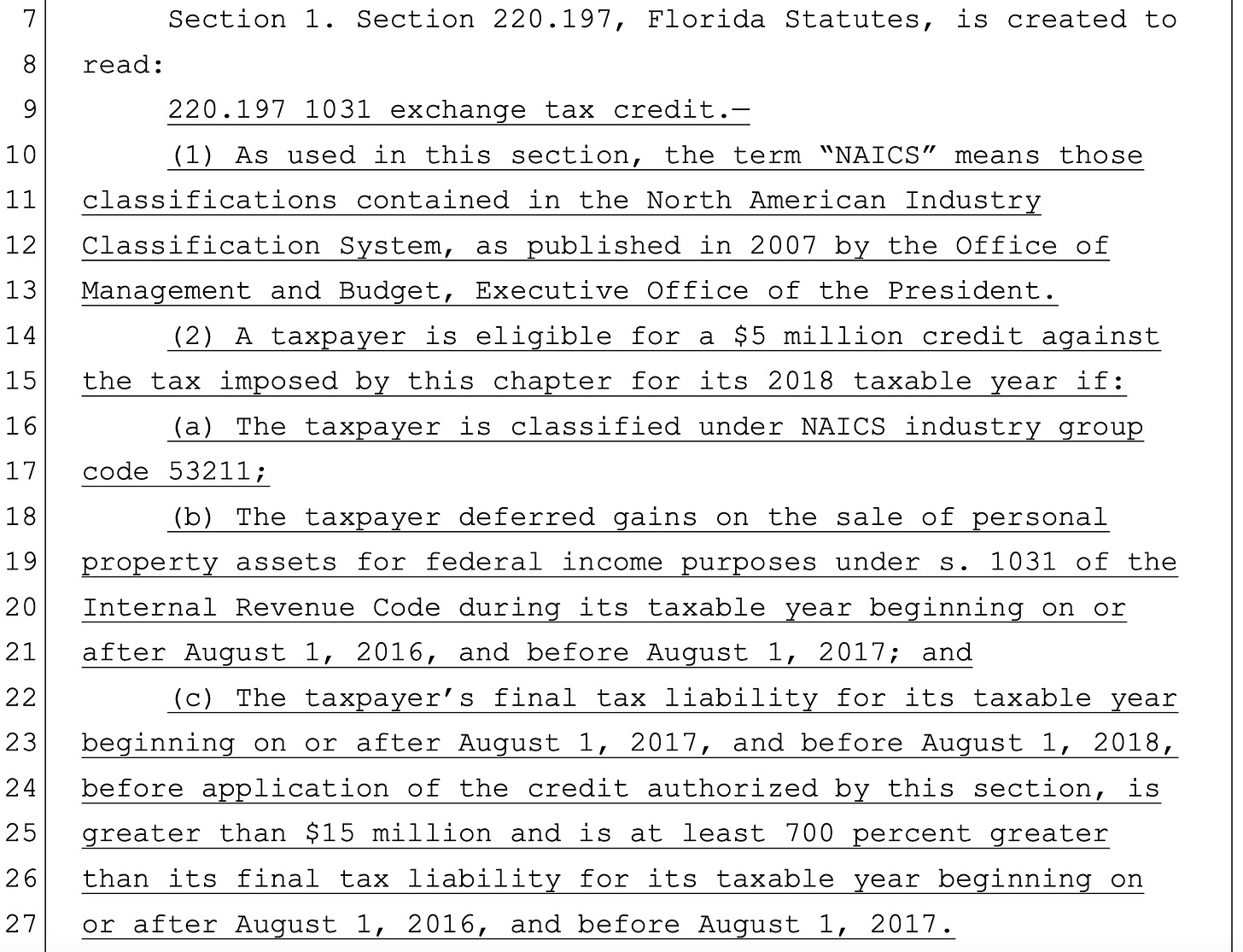

It has a North American Industrial Classification System code number of 53211 (that’s the NAICS code for car-rental companies);

It used 1031 exchanges during the 2017 tax year

Its 2018 Florida corporate tax bill was at least $15 million

Its 2018 Florida corporate tax bill was 1,000 percent higher than its 2017 tax bill

Now here’s the proposed amendment that’s been drafted this year in the Florida Senate:

It’s almost the exact language Avis asked for back in 2019, with just a few tweaks. It’s a $5 million tax credit for a car-rental company that had been using 1031 exchanges, whose 2018 Florida corporate tax bill was at least $15 million and was at least 700 percent higher than its 2017 tax bill.

The lower threshold was almost certainly chosen to ensure that another company or two could qualify. And in fact, when state economists looked at this language last week, they determined there are two companies likely to meet these four tests.

Obviously, Avis is one. The company basically wrote the bill.

The other is almost certainly Enterprise. Enterprise is more than twice as big as Avis and it had a record year in 2018 – making the company likely to meet that $15 million income tax test.

Enterprise also uses a fiscal year that ends on July 31 – which would certainly explain why this particular legislation makes sure to accommodate companies whose fiscal years start in August.

The only other plausible option is Hertz Global Holdings Inc. But Hertz, which is based in southwest Florida, is smaller. And it lost $225 million in 2018, so it probably didn’t have a big income tax bill that year.

Besides, legislative records show that Hertz lobbyists wrote themselves a different tax break last year that would have saved the company about $2.3 million. They worked on the idea with Passidomo, who, as incoming president, is the second most-powerful person in the Florida Senate.

Like Avis, Hertz has so far failed to get its tax break passed. But then again, maybe it’ll get a last-minute amendment this session, too.

I truly appreciate the thoroughness of your writing. To understand something like this requires getting into the weeds. You do so admirably so that an informed reader gets it.

Very interesting stuff, but a bit overwhelming since I receive 3 other newsletters and 3 daily briefs from the NY Times and others. How about a "condensed" version?