The Florida Legislature starts to move on a $4 billion tax cut for corporations

Ninety-nine percent of Florida businesses won’t save a penny.

This is Seeking Rents, a newsletter devoted to producing original journalism — and lifting up the journalism of others — that examines the many ways that businesses influence public policy across Florida, written by Jason Garcia.

Tomorrow morning, the Florida Legislature starts plowing ahead with a plan that would cut state taxes by nearly $4 billion over the next five years.

It may be hard to wrap your head around that amount of money. It’s roughly what the state of Florida has spent on affordable housing over the last 20 years (per the Florida Housing Coalition).

But don’t get too excited. You won’t see a penny of these savings.

No, this is a tax break for – and only for – Florida’s largest businesses.

This is not hyperbole. It’s math.

That’s because lawmakers are choosing to spend this $4 billion – and tax cuts are absolutely a form of spending – cutting the state’s tax on corporate profits. And that’s a tax that only the biggest businesses pay.

There are about 2.8 million active for-profit businesses in Florida. But 90 percent of them are entirely exempt from Florida’s corporate income tax. This is because they are organized as tax-exempt entities like “S” corporations or limited liability companies. These exemptions shield virtually all of Florida’s small businesses from the corporate tax (and a bunch of big, privately held companies, too).

That left exactly 250,399 businesses that had to file a state corporate income tax return for 2020, according to data from the Florida Department of Revenue.

But 90 percent of *those* businesses didn’t actually owe any tax. This is because Florida lawmakers have carved so many breaks into the corporate tax code over the years – and because they choose not do anything about well-known loopholes that big corporations are exploiting (and that most other states have closed).

The result: Only 21,256 companies actually paid state corporate taxes in 2020. That’s 0.8 percent of all Florida businesses. (Those weren’t all individual companies, by the way. Florida, unlike most states, lets big corporations with multiple subsidiaries file separate tax returns, a system that is ripe for exploitation.)

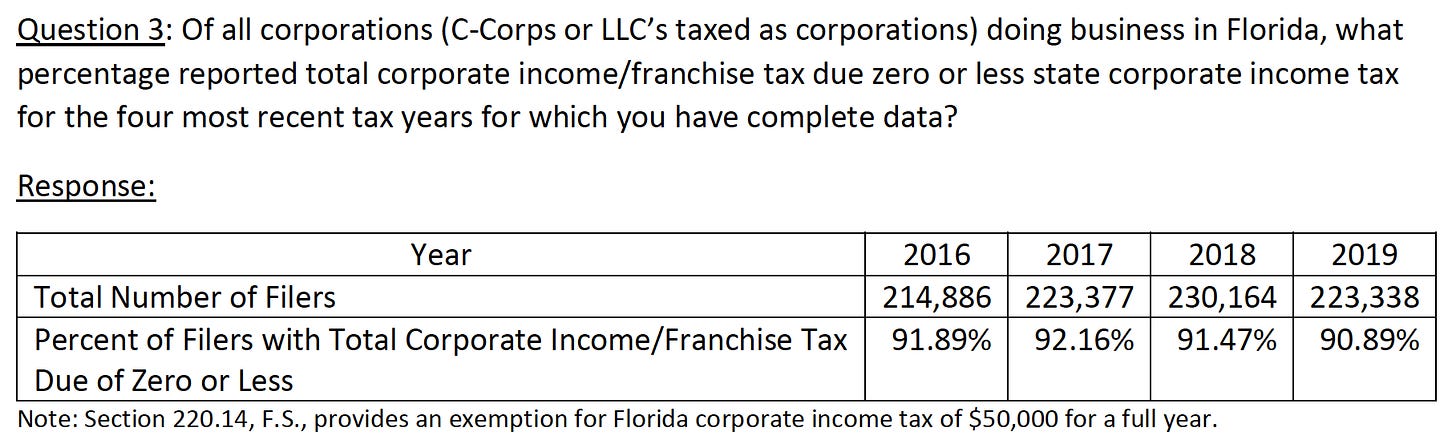

It’s not like 2020 was some low-water mark, either. Check out these figures from 2016 through 2019:

But wait: Corporate tax cuts are even more lopsided than that.

You might recall that Florida spent $543 million on corporate tax refunds in the spring of 2020. Gov. Ron DeSantis could have used his emergency powers to cancel them but chose not to because corporations “anticipated these refunds and have likely made business decisions around them.”

Well, it turns out that 18 percent of that money – $98 million – went to just 10 taxpayers. More than half – $275 million – went to just 100 taxpayers.

Again, that wasn’t some outlier year. The top 100 corporate taxpayers accounted for 48.4 percent of total corporate taxes paid in 2019, too, according to the revenue department.

In other words, if Florida cuts its corporate tax by $4 billion over the next five years, roughly $2 billion of those savings will probably go to about 100 companies.

That’s 50 percent of the savings for the top 0.01 percent of the businesses.

Corporate tax returns are confidential so we can’t say with certainty who the big winners of this windfall would be. But they are almost certainly the true multinational goliaths – corporations like Amazon.com Inc., Walt Disney Co. or Walmart Inc. (It’s probably a decent bet that hospital company HCA Healthcare Inc. would be among them.)

This is who the Florida Legislature is helping when it cuts the corporate income tax.

A bit more about the bills

There are two related corporate tax cut bills that will be heard tomorrow morning by the Florida Senate’s Finance and Tax Committee: SB 1090 and SB 952. Both are sponsored by Sen. Joe Gruters, the Sarasota-area Republican who also leads the Republican Party of Florida.

SB 1090 is the big one. It would be Florida’s answer to former President Donald Trump’s 2017 Tax Cuts and Jobs Act.

The Tax Cuts and Jobs Act gave corporations one of the deepest federal income tax cuts in American history. But it also made a number of changes that expanded the underlying tax base. That led to higher state tax bills because state corporate taxes “piggyback” off the federal corporate tax.

SB 1090 would have Florida opt out of – or “decouple” from – one of the big changes in the Tax Cuts and Jobs Act that expanded the underlying tax base. But it would also “couple” to a gigantic tax break in the TCJA – a federal tax break that Florida has historically opted out of, because the financial hit is so big. (The Florida Legislature has already granted one of the business lobby’s wishes by decoupling from another big part of the TCJA: A provision that is supposed to stop companies from shifting profits overseas.)

SB 952 is a smaller but related bill. It would increase a state tax break for corporations that spend lots of money on research and development. It’s designed to soften the hit from another one of those TCJA changes that reduced a federal tax break for R&D spending. (This is a big deal for defense contractors like Lockheed Martin Corp. and Boeing Co. and tech companies like Microsoft Corp. and Intel Corp.)

We’ll break down the individual pieces in more detail later. But the overall package mixes a couple of permanent tax reductions with a big temporary tax break that gives corporations savings up front that they *should* have to pay back later (assuming, of course, that corporate lobbyists don’t persuade lawmakers to make more changes down the road).

The combined result: Corporations would save approximately $3.6 billion in Florida taxes over the next five years. And they’d get a permanent tax cut of around $330 million a year further down the line. That’s according to the best estimates of state economists (who didn’t get very much help figuring this stuff out from corporations...even though corporations were supposed to provide help.)

Now, there’ll probably be a lot of talk tomorrow, and the rest of session, about how Florida has “increased” taxes on corporations since the Tax Cuts and Jobs Act passed in December 2017. But that ignores a couple of important points.

First, the Florida Legislature already gave corporations a roughly $3.6 billion tax cut to compensate for the effects of the Tax Cuts and Jobs Act. (Remember how much Florida has spent on affordable housing?)

These temporary tax cuts, passed in 2018 and 2019, include more than $1.1 billion in refunds – the $543 million paid out in 2020 and another $624 million that will be paid out this spring. And they include another $2.5 billion in savings from a temporary reduction to Florida’s corporate tax rate (which was lowered from 5.5 percent to 4.458 percent for 2019 and 2020 and to 3.535 percent for 2021).

And second, U.S. corporations are saving vast amounts of money overall thanks to the Tax Cuts and Jobs Act, because state corporate taxes are a small fraction of federal corporate taxes.

Just a couple of data points to illustrate this:

In the two years following the Tax Cuts and Jobs Act, federal corporate tax collections fell 37 percent relative to pre-TCJA forecasts, according to the Urban-Brookings Tax Policy Center – a savings of something like $150 billion.

And relative to gross domestic product – a measure of the size of the U.S. economy – federal corporate income has fallen in half since the TCJA, from 2 percent to 1 percent, according to the U.S. Treasury Department.

Is it possible – just possible – that Florida might have more pressing needs?

Contact: Garcia.JasonR@gmail.com