A big corporate tax break is lurking behind the scenes in Tallahassee

While Gov. Ron DeSantis and legislative leaders promise tax breaks for consumers, someone is quietly working on a bigger tax break for corporations.

This is Seeking Rents, a newsletter and podcast devoted to producing original journalism — and lifting up the journalism of others — that examines the many ways that businesses influence public policy across Florida, written by Jason Garcia. Seeking Rents is free to all. But please consider a voluntary paid subscription, if you can afford one, to help support our work.

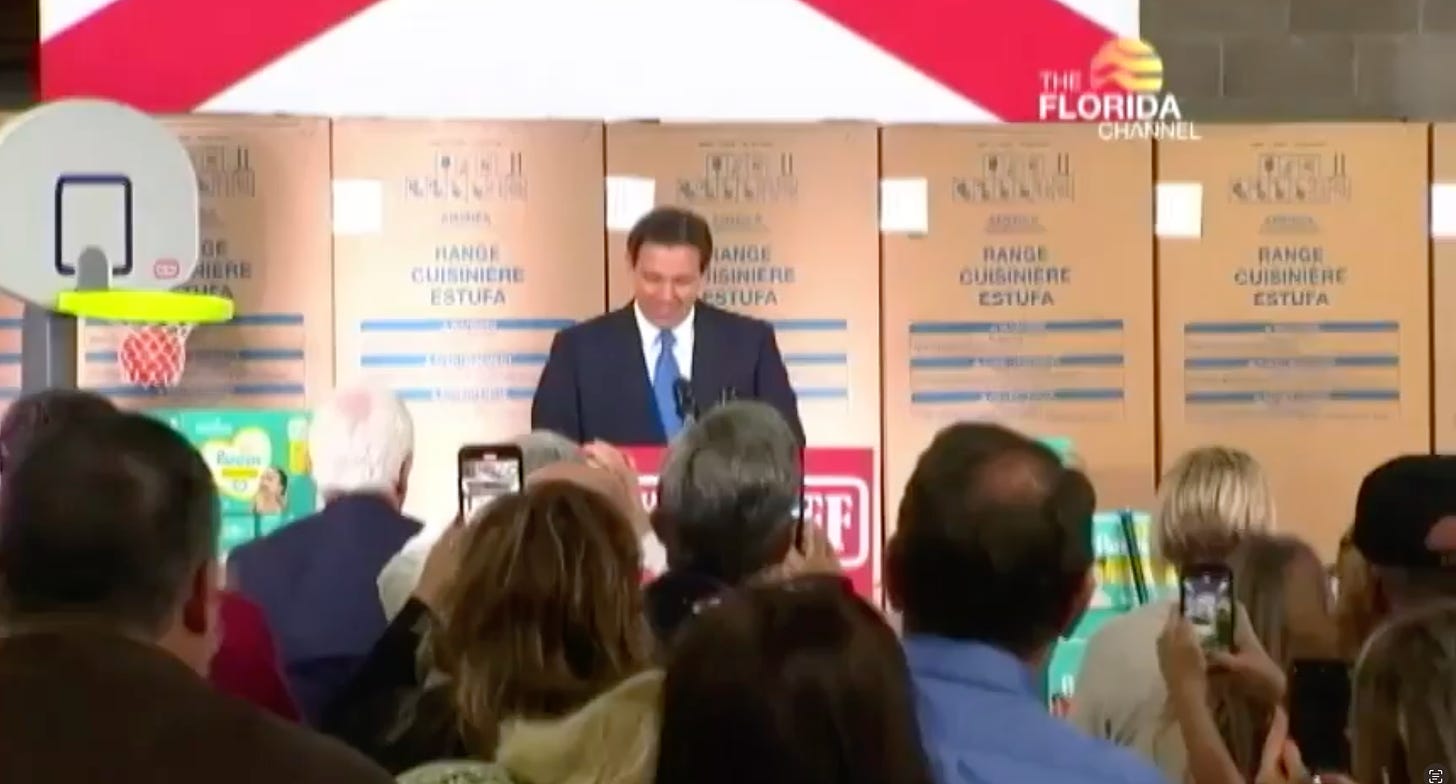

Gov. Ron DeSantis and the Republicans leadership of the Florida Legislature gathered at a small business in Ocala last week, where they vowed to pass a big package of tax breaks during the upcoming session that will directly help everyday Floridians.

Beaming for television cameras, basking in the applause of an enthusiastic audience, the governor, the speaker of the state House and the president of the state Senate promised a long list of broadly popular and bipartisan tax cuts on things like childcare needs, household goods and pet supplies.

But there is another proposed tax break lurking behind the scenes in Tallahassee — a tax break that would only benefit very big corporations.

This proposed tax break, which is being pushed by multinational giants like Anheuser-Busch InBev S.A., would slash the state’s tax on corporate profits. And it would be far more generous than any of the individual tax cuts that DeSantis and legislative leaders told the television cameras about last week.

Consider this: This corporate tax break could save large corporations approximately $360 million a year, according to estimates by independent state economists, who analyzed the proposal last week.

That’s roughly the same amount of money that Floridians would save from tax breaks that DeSantis has proposed on toothpaste, kids’ toys and pet food.

But this corporate tax break would be permanent. The tax breaks on toothpaste, kids’ toys and pet food would disappear after one year.

A big corporate tax cut made even bigger

This is a tax break that the world’s biggest companies have been trying to get from the Florida Legislature for five years now. It’s tied to a federal corporate tax cut that former President Trump enacted in late 2017, as part of Trump’s “Tax Cuts and Jobs Act.”

We’ve written a lot about this over the past year. But it’s worth walking through the history now that the lobbying campaign is beginning again.

The Tax Cuts and Jobs Act made a bunch of changes that made it harder for corporations to hide profits from taxes. For instance, the federal law narrowed some tax deductions. And it forced them to add back some profits they had slipped overseas.

But the Tax Cuts and Jobs Act also slashed the overall federal tax rate nearly in half — from 35 percent to 21 percent.

So corporations had to report bigger profits on their tax returns. But they got to pay a much lower tax rate. It all worked out to one of the largest federal corporate tax cuts in American history.

But there was a side effect.

That’s because state corporate taxes are intertwined with federal corporate taxes. So all those changes that forced corporations to report higher profits on their federal tax returns meant that they might have to report higher profits on their state tax returns, too.

And that meant they might have to pay higher state taxes.

Corporations were still going to save an enormous amount of money overall. It’s just that they would pay slightly more in state taxes — and a lot less in federal taxes.

But as soon as Trump signed the Tax Cuts and Jobs Act into law, corporate lobbyists fanned out to state Capitols around the country. They wanted state lawmakers to give them even more tax breaks by opting out of — or “decoupling” from — all of those federal changes that would make them post higher profits on their tax returns.

Florida gave away $4 billion

They had a lot of luck in Florida.

In 2018, former Gov. Rick Scott signed HB 7093. This bill slashed Florida’s corporate tax rate for one year (2019) and triggered a round of tax refunds for corporations, all to compensate for the side effects of the Tax Cuts and Jobs Act.

The bill was sponsored by state Rep. Paul Renner (R-Palm Coast), who is now the speaker of the state House. Renner said at the time that HB 7097 probably wouldn’t amount to much.

It ended up saving corporations — and costing the state of Florida — nearly $1 billion.

The very next year, Ron DeSantis gave corporations an even bigger gift by signing HB 7127. That bill slashed Florida’s corporate tax rate for another two years (2020 and 2021) and triggered a second round of giant tax refunds for corporations.

It saved corporations — and cost the state of Florida — another $2.8 billion.

But that wasn’t all. DeSantis also gave corporations a permanent tax break, too.

That’s because HB 7127 also permanently decoupled from one of those provisions in the Tax Cuts and Jobs Act — a provision that was meant to make sure companies pay taxes on profits shifted overseas.

Nobody knows for sure how much this permanent tax break saves corporations — and costs the state of Florida. But a preliminary analysis by the Florida Department of Revenue put the tab at $105.5 million every year.

And remember: Cutting Florida’s tax on corporate profits saves money for the very biggest corporations — and only the very biggest corporations.

Just 1 percent of companies doing business in Florida pay any corporate tax at all. And even those corporations pay much less than they should — because Florida leaders still allow corporations to use an absurd filing system that lets a big company pretend to be a bunch of smaller businesses just for tax purposes.

This system, known as “separate reporting,” makes it easy for giant businesses to divide themselves up in ways that allow them to exploit loopholes and shave millions of dollars off their Florida tax bills. Most other state have long since switched to a much fairer and more accurate system known as “combined reporting.”

But corporations want more

But I digress. So just to quickly recap: Five years ago, the federal government gave corporations an historically big federal tax cut. Florida then gave these same corporations a few extra helping of savings — including $3.8 billion in temporary tax cuts, plus a permanent tax cut worth another $100 million a year.

But, of course, corporations want even more.

Which brings us back to that big tax break lurking just offstage now in the state Capitol.

This proposal, which corporate lobbyists have tried to pass before, would have Florida permanently decouple from another major provision in the Tax Cuts and Jobs Act — a provision that narrowed a tax deduction corporations use when they borrow money.

Decoupling from these limits on interest deductions would be a huge tax break. State economists estimate it would save corporations — and cost the state of Florida — roughly $360 million a year.

There are some powerful forces pushing for this.

For instance, emails show that lobbyists for beer giant Anheuser-Busch InBev have met with key lawmakers about it.

But it goes far beyond the company that makes Bud Light.

Many other big corporations have been lobbying hard, too, through front groups like the Florida Chamber of Commerce and a national organization called the “Council on State Taxation” — which represents multinationals like Amazon, Coca-Cola, Nike and Walmart.

Putting Ron DeSantis’ rhetoric to the test

Almost exactly one year ago, Ron DeSantis gave a speech to supporters and staff at Hillsdale College, the private Christian college and conservative thought factory in Michigan that the DeSantis administration sees as a model for New College of Florida in Sarasota.

During his remarks, the Republican governor — and probably soon-to-be presidential candidate — claimed that he has begun to question the wisdom of corporate tax breaks.

“The Republican Party has been very good at saying cut taxes for corporations,” DeSantis said, according to The American Conservative, a magazine that covered his speech. “But now, corporations are getting so woke, do we really want to cut their taxes? I’m not saying raise them, but we’re getting away from what the average American cares about.”

DeSantis is about to get the chance to walk that talk.

Republicans in the Florida Legislature wouldn’t dare pass a big corporate tax break if the governor publicly objects.

All he has to do is speak up.