Florida leaders are forcing thousands of homeowners to pay higher prices for property insurance

Nearly 18 months after Gov. Ron DeSantis signed an industry-backed overhaul of Florida's insurance laws, the bills are coming due for many Florida homeowners.

This is Seeking Rents, a newsletter and podcast devoted to producing original journalism — and lifting up the journalism of others — that examines the many ways that businesses influence public policy across Florida, written by Jason Garcia. Seeking Rents is free to all. But please consider a voluntary paid subscription, if you can afford one, to help support our work.

The letter started so cheerfully.

“Great news!” Citizens Property Insurance Corp. wrote last August to Scott Bassett, a homeowner in central Florida.

Bassett, who owns a 66-year-old, three-bedroom home in Orlando, was a customer of Citizens. He’d purchased a policy from Florida’s public property insurance company after the private insurer he had been buying his insurance from nearly tripled his premium in two years. But Citizens had found a new private company willing to cover Bassett’s home.

He had to flip to the second page to find the catch: The new policy — offered by a two-year-old company called Slide Insurance — would cost $3,501. That was more than $1,000 higher than his premium with Citizens. It would have been an increase of more than 40 percent. Bassett decided to stay with Citizens.

But eight months later, Bassett is being forced into Slide anyway. Not because the private insurer lowered its prices — but because Citizens, which is run by political appointees of Gov. Ron DeSantis and other elected Republican leaders in Tallahassee, raised its own prices so steeply that Bassett no longer had any choice.

The episode is the direct impact of controversial changes to Florida’s homeowner’s insurance market that DeSantis and the GOP-controlled Florida Legislature enacted in December 2022, just after DeSantis was re-elected governor in a campaign in which Republicans outspent Democrats by more than $100 million.

DeSantis’ insurance overhaul was promoted and cheered by insurance industry lobbyists and executives. Many of those companies are also lavish campaign contributors: Records show that Slide Insurance alone has given nearly $1 million to Florida politicians and political parties since 2022 — virtually all of it to Republicans, who control the Governor’s Office, both chambers of the Legislature, and the Chief Financial Officer’s office, which is involved in insurance regulation.

But those same changes are now forcing Floridians like Bassett to pay far higher prices for their homeowner’s insurance.

“Where does it stop?” said Jill Young, another Orlando homeowner who has just been forced out of Citizens and into Slide — for a policy that is also about $1,000 more expensive. “People are going to be bankrupt out of their homes just because they can’t afford insurance.”

‘Historic’ reforms, higher prices

Ron DeSantis signed his insurance overhaul on Dec. 16, 2022, and it remains one of the most important policy decisions of his tenure as governor. DeSantis himself called the changes “historic reforms” that would lead to more stability, competition, and choice in Florida’s ailing property insurance market.

Much of the debate at the time focused on provisions that protect insurance companies from civil lawsuits and make it more difficult for customers to fight back in court against insurers they feel have unfairly delayed, denied, or underpaid a claim.

But some of the harshest changes in the legislation dealt with the hundreds of thousands of Floridians who count on Citizens to insure their homes.

Initially conceived as a safety net for Florida home- and business-owners who could not find affordable property insurance on the private market, Citizens has ballooned into the biggest insurance company in the state as private carriers have hiked rates, canceled policies, or collapsed altogether.

It has always been hard to qualify for insurance coverage from Citizens, which is often described as the state’s “insurer of last resort.” But it used to be that — once you did qualify for coverage — you could keep that policy as long as you wanted it. You could generally only be pushed out of the public insurance company if a private company came along and offered to sell you a comparable insurance policy at or below the premium you were paying to Citizens.

DeSantis and Florida lawmakers changed those rules. Now, Floridians who buy their homeowner’s insurance from Citizens can be forced to give up their public coverage for private insurance even if that private insurance is more expensive. You can only elect to keep your Citizens coverage if the price offered by the private insurer would amount to an increase of more than 20 percent.

That wasn’t the only change meant to get more Floridians paying higher prices for their insurance.

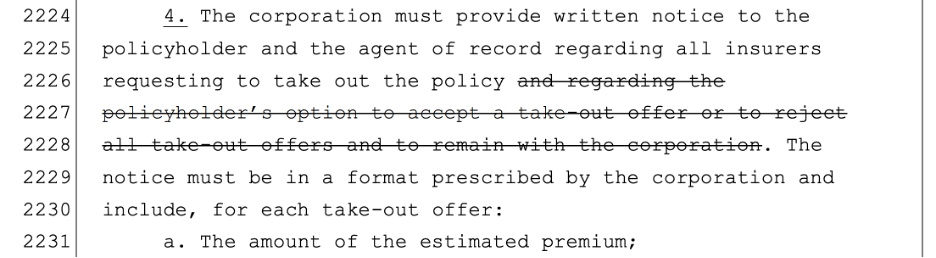

For example, when a private company wants to pull someone out of Citizens — to make what is often called a “takeout offer” — state law used to explicitly require that Citizens also clearly inform the homeowner if they have the right to reject the offer and stay with Citizens instead.

DeSantis’ insurance law eliminated that requirement.

Florida also used to have an extra consumer protection in place for Citizens policyholders who were transferred to private carriers. That protection ensured that, if your policy was taken over by a private company, that private company could not immediately begin raising your annual premium faster than Citizens could have, had you remained covered by the public insurance company.

DeSantis’ insurance law erased that protection, too.

Insurance industry lobbyists and other supporters of the new law say this is all designed to get as many people as possible out of Citizens and covered by private companies instead.

That’s important, they say, because if Citizens were to run out of money to pay claims after a series of major storms, the state-backed company could levy a tax on nearly all property insurance policies in Florida, both public and private, to raise more money. Encouraging private takeouts helps reduce Citizens’ exposure — and thus the risk of any such tax.

But that’s only part of the equation. Because allowing private insurers to cherry pick policies from Citizens — while leaving the riskiest policies behind with the public company — makes Citizens more vulnerable to running out of money and having to levy an emergency tax.

What’s more, when a private insurance company fails, the state can also end up levying a tax on all property insurance policies to cover their claims, too.

Forced into more expensive insurance

Regardless of the rationale, the changes wrought by DeSantis and the Florida Legislature in December 2022 have led directly to tens of thousands of Floridians — at least — paying higher prices for their property insurance.

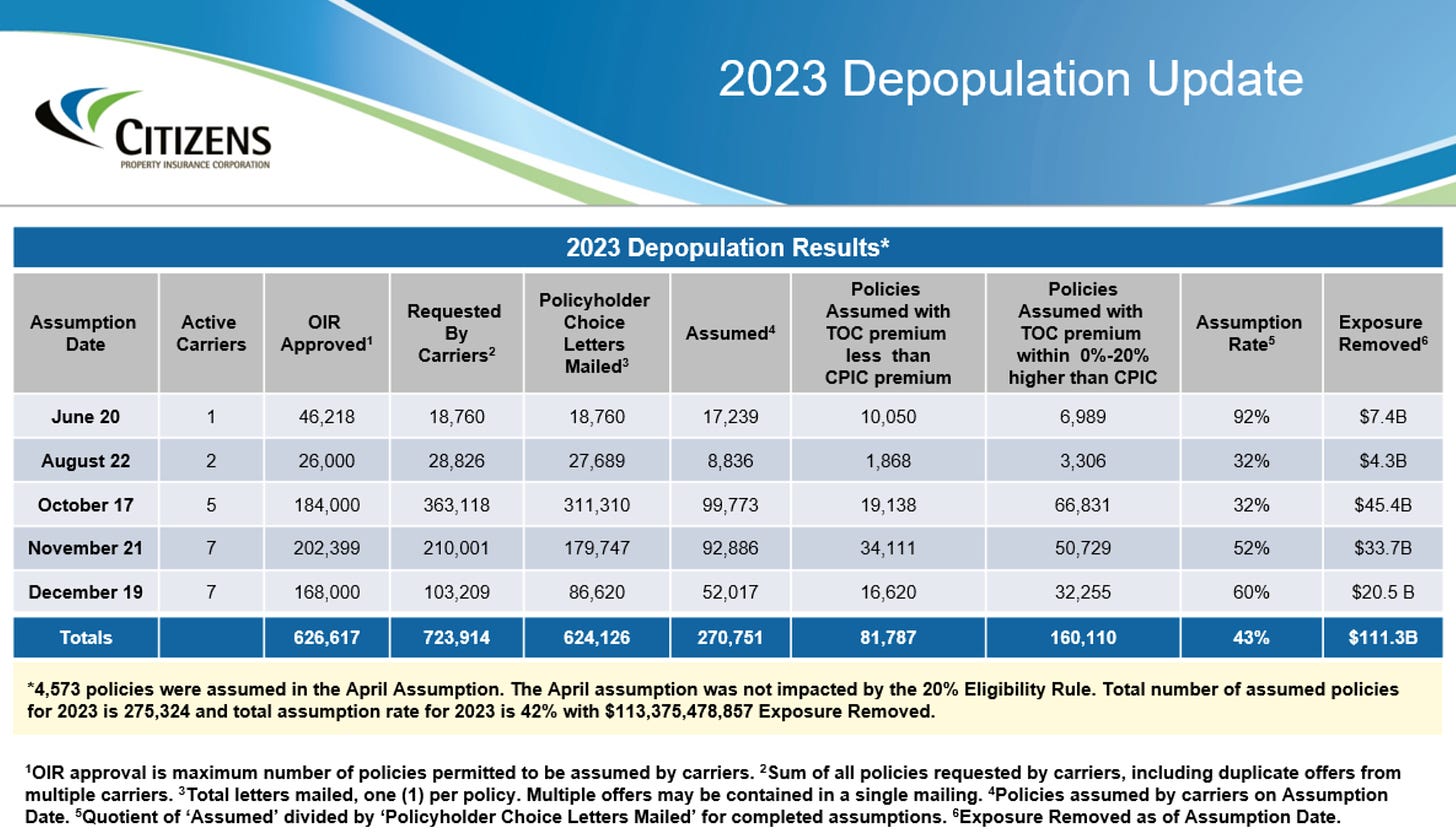

For instance, in the first year the new rules were in effect, data from Citizens show that a dozen private insurance companies pulled about 275,000 policies combined out of Citizens. At least 188,000 of those policyholders — nearly 70 percent — are paying higher prices than they had been at Citizens.

Private insurers have taken another 115,000 policies out of Citizens so far this year. And at least 84,000 of those policyholders — nearly 75 percent — are being put into more expensive policies, too.

These takeovers have been pushed along by some classic anti-consumer tactics.

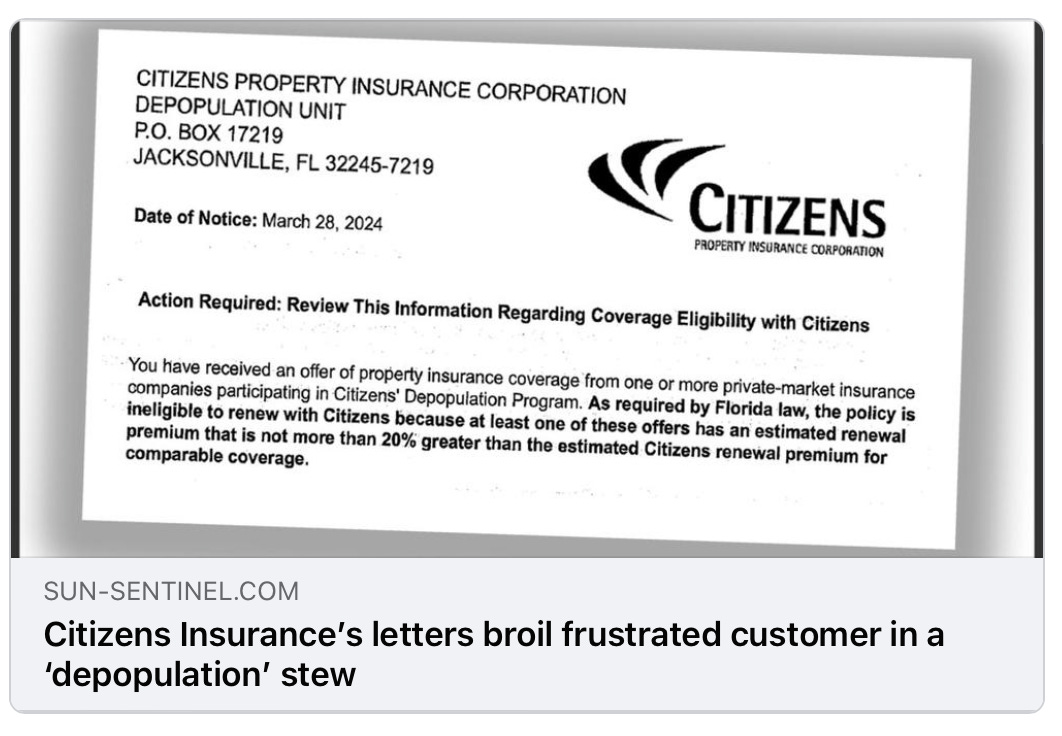

For example, when a private insurance company offers to take a policy out of Citizens, Citizens will mail a notice to the homeowner. And even if the private company’s price is more than 20 percent higher than Citizens, Citizens will require the homeowner to proactively opt out in order to avoid being transferred.

A homeowner who misses the notice, or who forgets to respond in time, will get punted to the more expensive private policy by default.

Some private companies seem to count on Floridians failing to understand the importance of these takeout notices.

“You send out these [takeout] notices, and it gets mixed in with everybody’s junk mail; in the trash can it goes. Next thing you know, you’ve got 200,000 customers,” Bruce Lucas, the CEO of Slide Insurance, told the “Insurance Guys Podcast” in 2022. The remarks were first reported by The Washington Post.

Slide, which was founded in February 2022, has quickly become one of Florida’s most notorious new insurance companies.

In fact, at one point, according to the Florida Office of Insurance Regulation, Slide was sending out takeout offers to Citizens customers at prices that were as much as five times more expensive than their current premiums. And the targeted homeowners were at risk of getting trapped in those policies simply because they failed to respond to a letter that could so easily be mistaken for junk mail.

Slide’s tactics prompted the Office of Insurance Regulation to cap takeout offers at no more than 40 percent of the Citizens price. The new rule went into effect late last year.

“We had one company that was an outlier that was making offers of 300-to-500 percent higher than everyone else,” Florida Insurance Commissioner Michael Yarkosky told the Senate Banking and Insurance Committee in October.

The Office of Insurance Regulation confirmed that the company was Slide.

In written answers issued by a spokesperson, Slide said it follows all rules set by the Office of Insurance Regulation and Citizens. The company said it supported the decision to cap Citizens takeout offers.

“Previously, an offer was presented for the policyholders’ consideration regardless of the rate difference,” Slide said. “In instances where we cannot present an offer that is within 40% of the policyholder’s estimated Citizens renewal rates, we no longer submit an offer.”

Despite the controversy, state officials continue to steer tens of thousands of Floridians to Slide.

State data show that Florida insurance regulators gave Slide permission to take out up to 250,000 policies from Citizens last year. No other insurance company was approved for more than 100,000 takeouts.

Slide has also been given permission to pull as many as 110,000 policies out of Citizens so far in 2024. No other insurer has been approved for more than 65,000 policies.

Slide works hard to maintain warm relationships with Florida leaders. In the two-plus years since Slide was founded, records show the company has donated $961,000 to Florida politicians and political parties. That’s more than any other homeowner’s insurance company has spent on state-level campaign contributions over the same span, according to a Seeking Rents review of property insurance contributions.

Almost all of the company’s donations — $954,000 — went to Republicans, including $245,000 to the Republican Party of Florida and another $210,000 to a related fund controlled specifically by GOP leaders in the state Senate.

Slide has also given $150,000 to Republican Chief Financial Officer Jimmy Patronis; $65,000 to incoming Senate President Ben Albritton (R-Wauchula); and $37,500 to incoming House Speaker Danny Perez (R-Miami).

“Slide is an active participant in democracy and, like many other companies, makes regular campaign donations to both sides of the political aisle, as permitted by state and federal laws,” Slide said in its statement.

‘This seems slimy’

The experience of Bassett, the Orlando homeowner who is getting kicked out of Citizens and into Slide, illustrates how this is all now playing out for many people.

The South Florida Sun-Sentinel recently chronicled Bassett’s story in detail. But the abbreviated version is that Slide tried several times to capture the Orlando homeowner as a customer.

Slide’s first attempt came in August 2023, when it offered Bassett a policy for $3,501. But that was 43 percent higher than Citizens’ estimated renewal price of $2,451. So Bassett notified the state that he wanted to remain with Citizens.

Slide’s final attempt arrived in Bassett’s mailbox in March. The company offered a policy at basically the same price: $3,500. But this time, Citizens’ estimated renewal price was much higher: $3,023. That meant that Slide’s quote was only 16 percent more expensive — and that Bassett had no choice but to accept it.

What changed? Slide’s final offer was for an insurance policy that won’t actually kick in until next year. That appears to have let Citizens bake a large annual rate increase into its new estimate — even though state regulators haven’t yet approved any such increase for Citizens.

Both Slide’s quote and Citizens’ quote could change before the new policy takes effect in May 2025. And yet Slide’s takeout of Bassett’s policy is being sealed now.

A spokesperson for Citizens said private insurers are allowed to make takeout offers up to one year in advance. Citizens also said that its price quotes regularly fluctuate based on a variety of factors, such as estimated replacement costs and coverage changes. And Slide said all of its offers are based on rates that have been approved by Florida regulators.

But Bassett suspects the two companies teamed up to push into him the higher-priced private insurance.

“There seems to be some collusion between Citizens and Slide,” Bassett said. “This seems slimy.”

Jumbo Patronis is receiving money from Slide. How is this allowable other than Republicans don't subscribe to anything ethical. There is no neutrality in Florida GOP. If you are a Floridian and you still vote Republican, you have to look at what they are doing behind the curtains. Ron complains constantly about the cost of living in California and NY but guess what.....Florida is exploding to the upside in cost of living. Don't give me that nonsense about "no state income tax". All the other fees and hundreds of miles of tolls roads, traffic gridlock on outdated roadways, ballooning housing costs on crappy salaries are zooming right past CAL and NY.

I'm sorry but I have to say it again. Floridians will have to bear the financial pain of shady Republican policy installations to finally realize that they have been HAD. More people will have to leave the state, move out for them to get angry enough to vote for wholesale change in Tallahassee. It's the only way.