Florida Republicans protected insurance companies from competition. Florida homeowners are now paying higher prices.

To protect the profits of private insurance companies, Gov. Ron DeSantis and the GOP-controlled Florida Legislature are forcing a public nonprofit insurer to charge inflated prices.

This is Seeking Rents, a newsletter and podcast devoted to producing original journalism — and lifting up the journalism of others — that examines the many ways that businesses influence public policy across Florida, written by Jason Garcia. Seeking Rents is free to all. But please consider a voluntary paid subscription, if you can afford one, to help support our work.

In 2007, Florida made a fundamental change to its home insurance market.

It involved Citizens Property Insurance Corporation, the nonprofit property insurance company created by the state.

Citizens had initially been conceived as an “insurer of last resort” — a public insurance company that would sell coverage to Florida homeowners who private companies refused to cover themselves.

Like any other insurance company, Citizens was required by law to set rates that were “actuarily sound.” That meant the company’s prices had to be high enough that Citizens would raise enough money in annual premiums to cover its expected claims.

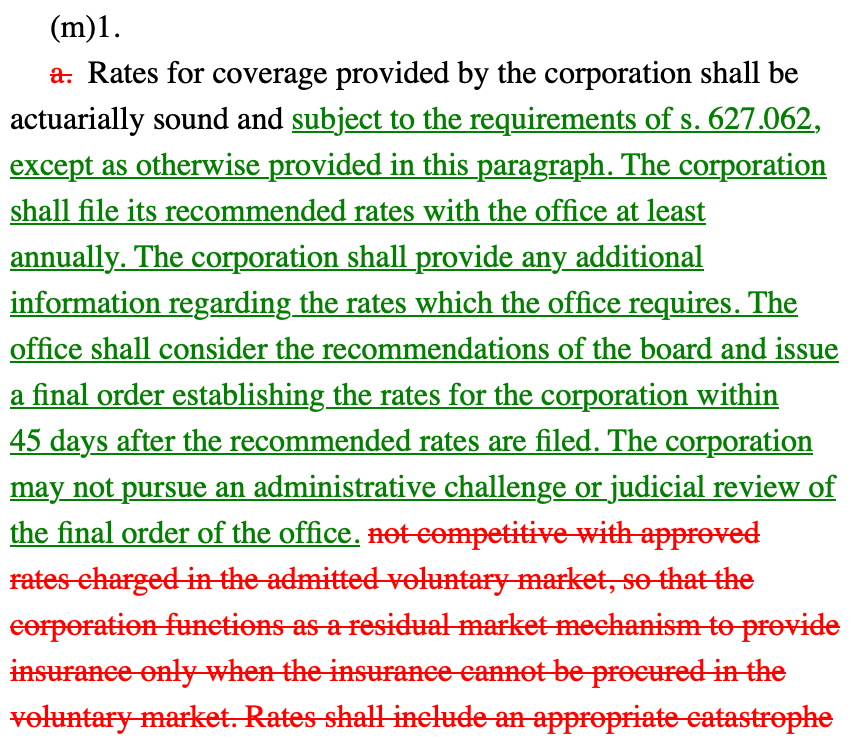

But unlike any other insurance company, Citizens was also forced to set rates that were higher than everyone else.

It was nakedly anti-competitive protection for the for-profit insurance industry, which did not want to be undercut on price by a nonprofit alternative free of shareholders demanding a return on their investment. And it forced many Floridians to pay higher-than-necessary prices to insure their homes.

Florida leaders finally removed that restriction when private insurers began rapidly raising rates in the aftermath of chaotic hurricane seasons in 2004 and 2005. They did so through a bill that former Gov. Charlie Crist pushed through the state Legislature in January 2007 — a bill that the for-profit insurance industry despised.

Under that legislation, Citizens still had to set actuarially sound rates. But the company was no longer required to keep pushing its prices even higher, just to protect private-market profits.

The change helped turn the nonprofit Citizens into an option for more Florida homeowners who would otherwise have no choice to but swallow skyrocketing prices on the for-profit market.

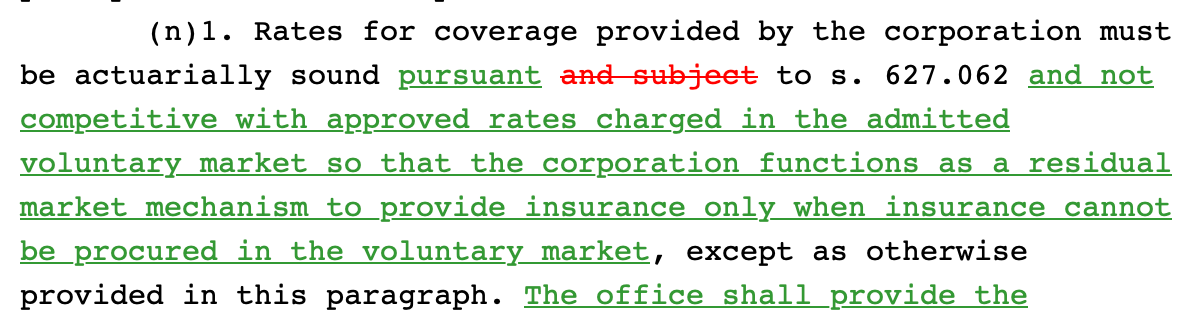

But 15 years later, a new generation of Florida leaders decided to take their state backwards.

They did so through a bill that current Gov. Ron DeSantis pushed through the state Legislature in December 2022 — a bill that the for-profit insurance industry adored.

Under the new legislation, Citizens is once again forbidden from charging prices that would be competitive with the private sector. And many Floridians are once again paying higher-than-necessary prices for their home insurance.

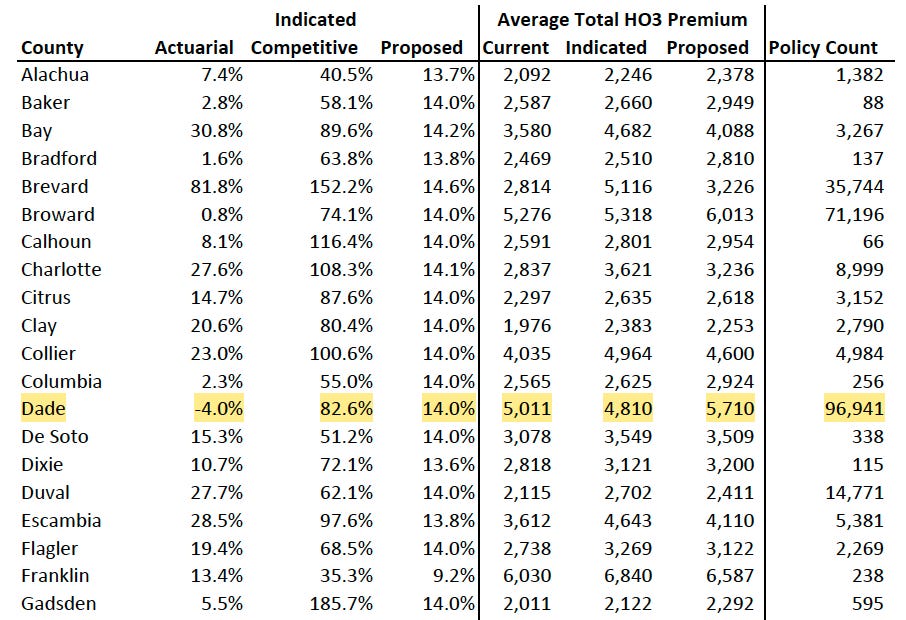

Consider Miami-Dade County, where Citizens has roughly 100,000 standard homeowner’s policies right now.

If Citizens were simply required to charge actuarially sound prices, the company could reduce its basic rates in Miami by 4 percent. That’s according to Citizens’ own calculations.

But because DeSantis and lawmakers are once again forcing the nonprofit insurer to artificially inflate its rates, Citizens plans to raise rates in Miami by 14 percent this year — which is the maximum annual increase it can impose under current law.

And it won’t stop there. Citizens’ calculations show that it would ultimately have to raise homeowners’ rates in Miami by more than 80 percent in order to avoid competing with the private market.

That’s right. Florida leaders created a nonprofit insurance company that could lower its rates in Miami tomorrow and still be financially sound. But instead, they have ordered the company to nearly double its prices.

Miami isn’t all that much of an outlier, either.

In Broward County, where Citizens has more than 70,000 homeowners’ policies, the company’s rates are basically right where they should be, from an actuarial standpoint. But Citizens says it will still have to increase those rates by another 74 percent to be non-competitive with the private market.

In Palm Beach County, Citizens’ rates have to rise 10 percent to be sound but 81 percent to be uncompetitive. In Sarasota, they must climb 24 percent to be sound but 115 percent to be uncompetitive. And in Pinellas County, they have to jump 32 percent to be sound but 143 percent to be uncompetitive.

But the place in Florida that’s getting the rawest deal out of this protectionist favor for the insurance industry is tiny Gadsden County — an inland community in north Florida that also happens to be the only majority Black county in the state.

According to Citizens’ estimates, the company only needs to inch its rates up by about 5 percent in Gadsden County in order to be actuarially sound.

But because Republican leaders in Tallahassee don’t want a public nonprofit undercutting private for-profits, Citizens may have to jack its rates up in Gadsden by more than 185 percent — nearly triple its current prices.

And republicans will blame bidenflation for this

Florida is California…