How home insurance companies in Florida sidestep rules meant to prevent excess profits

A new financial review by state insurance regulators reveals an elaborate money maze.

This is Seeking Rents, a newsletter and podcast devoted to producing original journalism — and lifting up the journalism of others — that examines the many ways that businesses influence public policy across Florida, written by Jason Garcia. Seeking Rents is free to all. But please consider a voluntary paid subscription, if you can afford one, to help support our work.

Slide Insurance Company lost money in 2022 — at least on paper.

The Tampa-based insurer, which has rapidly become one of the biggest home insurance companies in Florida, lost a little more than $1.3 million for the year, according to a recently completed review of the company’s finances by state insurance regulators.

But that apparent loss came after Slide shifted tens of millions of dollars into other corporate subsidiaries.

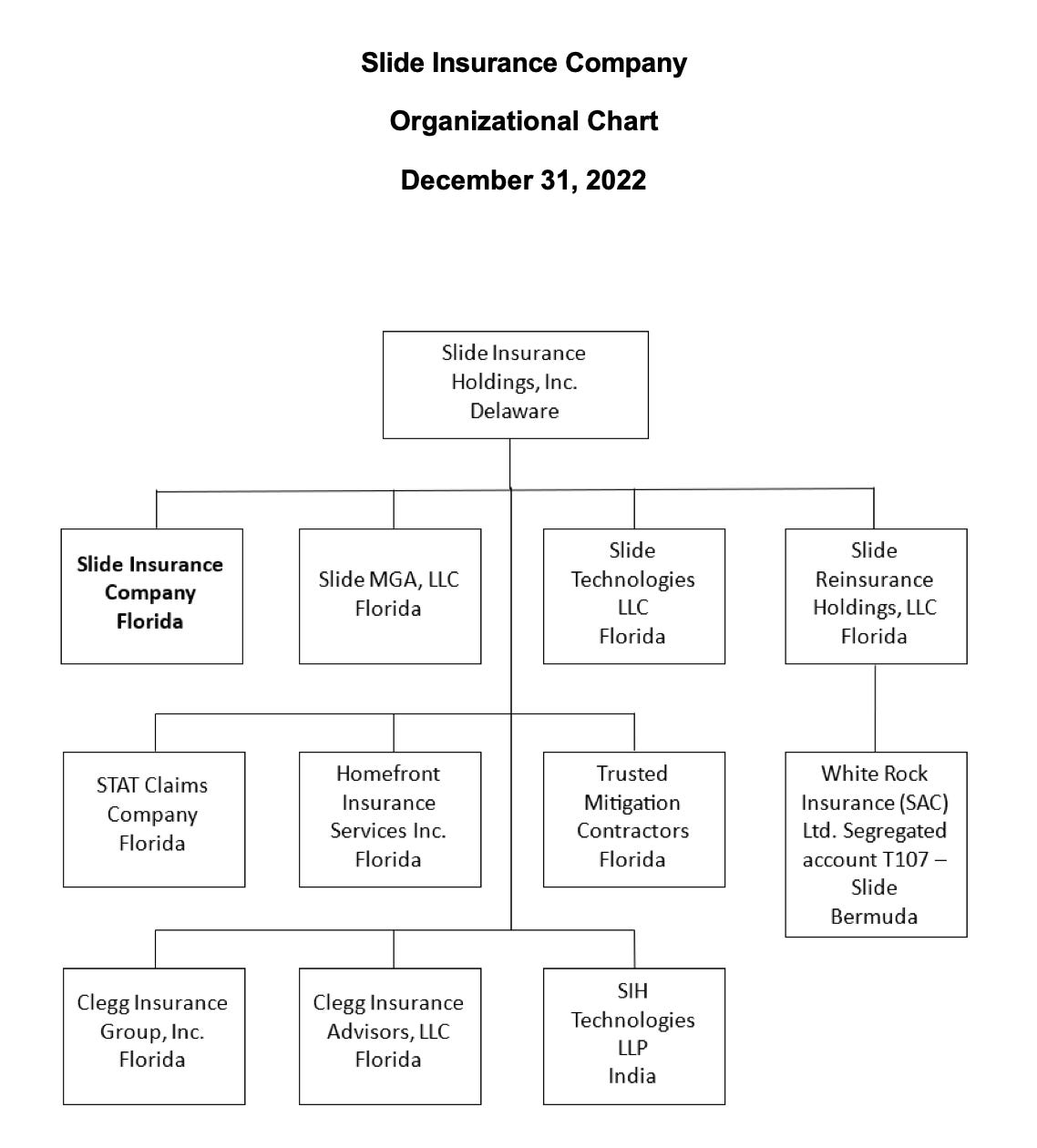

For instance, the same report shows that Slide Insurance paid $79.8 million in 2022 to a related company, called “Slide MGA LLC,” for policy processing, claims handling and other services. It paid another $49.1 million to another affiliate, called “STAT Claims Company,” for claims adjusting. And it paid at least $2.2 million more to yet another corporate cousin, “Slide Reinsurance Holdings LLC,” for reinsurance coverage.

All four companies — Slide Insurance, Slide MGA, STAT Claims, and Slide Reinsurance — are part of the same parent corporation: Slide Insurance Holdings Inc., whose top investors include a larger insurance company, Tampa-based Heritage Insurance Holdings, plus a pair of Tampa-based investment firms.

All told, that’s more than $130 million essentially passed from one corporate pocket to another. And it may not be all, either. The same report shows that Slide Insurance also took out a 10-year, $13 million loan from its parent corporation in 2022 — at a 12 percent interest rate, with interest payments due every quarter.

So, while 2022 may have been tough on Slide Insurance Company itself, it may still have been a very good year for the corporation as a whole. (Representatives for Slide declined to answer questions about the company’s finances — including whether the overall company was profitable in 2022.)

The financial maneuvering at Slide Insurance illustrates one of the biggest challenges facing everyone from policymakers to policyholders who try to follow the money in Florida’s property insurance market.

In theory, home insurance companies are tightly regulated by state laws that permit shareholders to earn a reasonable rate of return on their investments — but prohibit them from soaking homeowners for excess profits.

But in practice, some companies have found ways to sidestep those rules by devising byzantine corporate structures and using internal transactions to move money out of their regulated insurance business and into unregulated affiliates.

This can not only enrich executives and shareholders — it can leave the underlying insurance company thinly capitalized and vulnerable to collapse.

Slide is not necessarily unique. Many of the companies currently writing home insurance in Florida move their money through similar mazes. A 2021 examination of American Integrity Insurance found that the company was paying fees to at least three different corporate affiliates. A 2022 examination of People’s Trust Insurance Company found that it was paying fees to at least three corporate affiliates, too.

But it is becoming harder to evaluate these kind of internal agreements and fee structures, because companies are increasingly hiding behind broad laws that allow them to claim many of their records are proprietary business information or trade secrets that are exempt from Florida’s public-records rules.

For instance, many Florida insurance companies pay fees to a separate “managing general agency” that is owned by the same investors. The amount of those fees has in recent years ranged from between 20 percent and 30 percent of the premiums that the insurance company collects from homeowners, plus an extra $25 for each policy, according to a review of financial examination reports published in previous years.

But it’s not clear how Slide’s fee structure compares. That company is currently suing to stop the Florida Office of Insurance Regulation from releasing a copy of its managing general agency agreement in response to a public-records request.

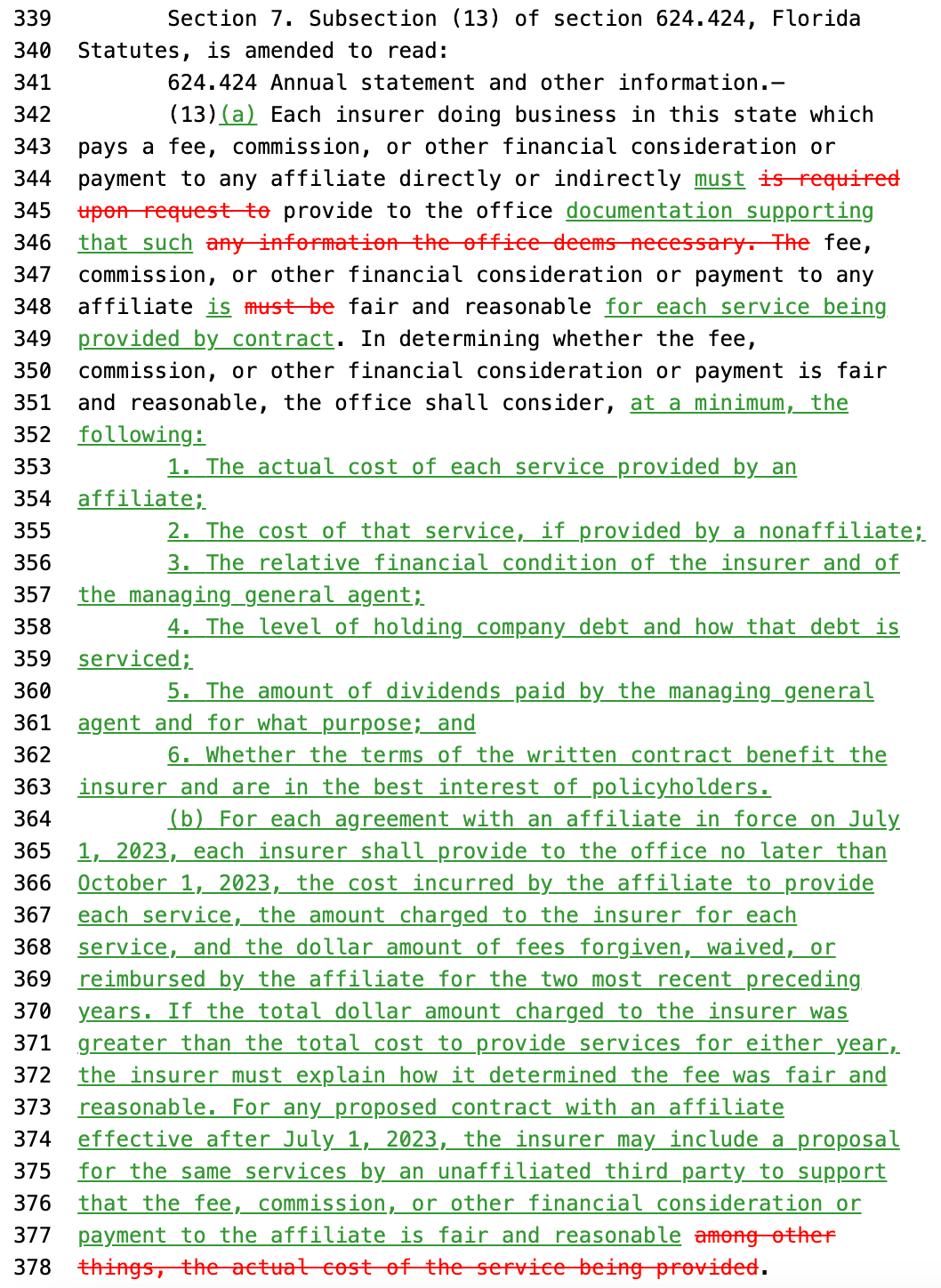

State insurance regulators asked for more authority to scrutinize internal transactions — to ensure that companies are’t paying themselves inflated prices and to put a stop to any potential profit-stripping. But Florida’s Republican-dominated state Legislature refused to give it to them.

Specifically, in 2023, the state’s Office of Insurance Regulation proposed legislation that would have required property insurers to disclose more details about internal transactions and required regulators to do more rigorous analyses of them. The idea was initially included as part of a larger insurance package filed in the Florida Senate.

The insurance industry immediately objected. “We have started hearing from all kinds of insurance companies that are…concerned with how this bill will impact them,” Carolyn Johnson, a lobbyist for the Florida Chamber of Commerce, told the Senate’s Banking and Insurance Committee.

Lawmakers listened. Republican legislative leaders quietly removed that provision from the bill before passing it.

Sen. Travis Hutson, a Republican from near Jacksonville, later told the Tampa Bay Times that lawmakers did not want to “upset the apple cart” on the insurance industry. (Sidenote: A review of Florida campaign finance data shows that home insurers made more than $3 million in political contributions in 2023 alone.)

But it also seems as if some lawmakers wanted a cut of the action for themselves.

A few months later, the Times reported that state Sen. Joe Gruters — a Republican from near Sarasota who is now campaigning for election as Florida’s chief financial officer — began pitching his fellow lawmakers on investing in a new home insurance company.

Gruters’ investment pitch emphasized the potential to earn “exceptional returns” — 165 percent over five years — by collecting premiums from homeowners and then shifting much of that money out of the regulated insurance company and into an unregulated affiliate.

Remarkable.

Somehow this feels like a corner "shell game" and someone will be left holding the bag. Notice how they grew so fast and notice the campaign donations to the Republican Mafia of Tallahassee. If Florida receives 2-3 Cat 4 or Cat 5 Hurricanes this year, it could come crashing down on this "fix".