Koch Industries is laying off hundreds in a hurricane-stricken community. Florida might give the company a tax break anyway.

One of the world's wealthiest billionaires also stands to benefit from tax breaks included in a hurricane-relief package that Florida lawmakers are expected to pass this week.

This is Seeking Rents, a newsletter and podcast devoted to producing original journalism — and lifting up the journalism of others — that examines the many ways that businesses influence public policy across Florida, written by Jason Garcia. Seeking Rents is free to all. But please consider a voluntary paid subscription, if you can afford one, to help support our work

In mid-September, just three weeks after Hurricane Idalia tore through Taylor County in North Florida, the tiny community suffered a second disaster.

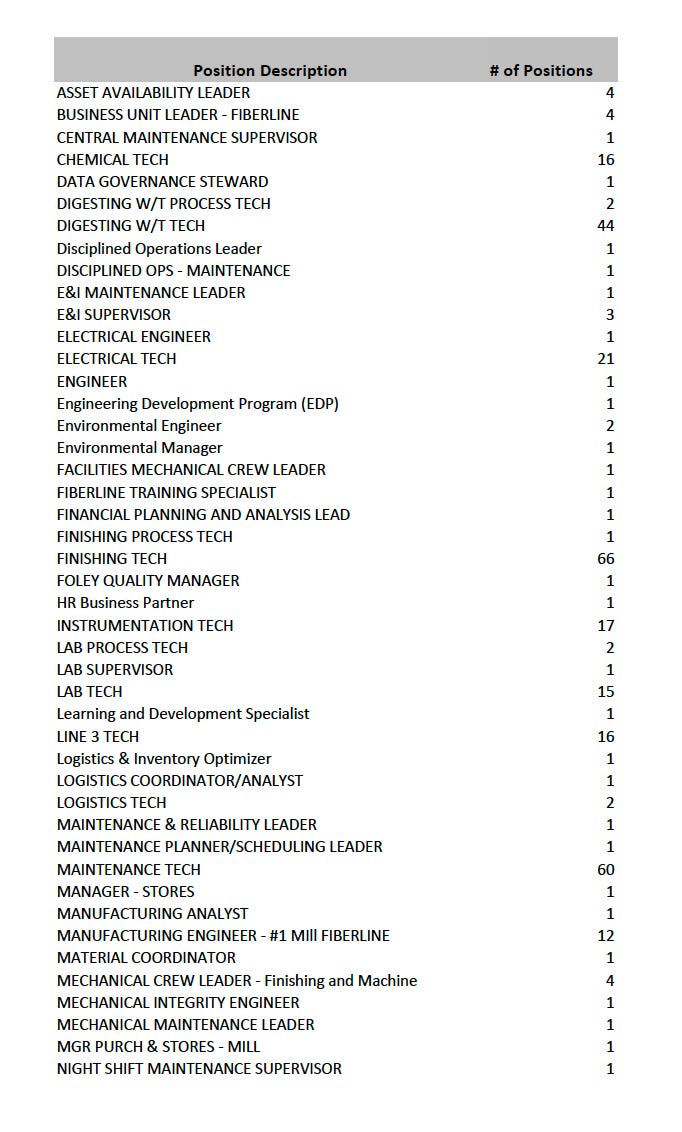

The company that operates a large pulp-and-fiber mill in the area — a 69-year-old factory known locally as the “Foley mill” that has long been one of the region’s most important employers — announced that it would shut the facility down and lay off all 500-plus people who work there.

It’s a devastating blow to Taylor County, a timber-dependent community with a shrinking population of fewer than 22,000 people where one-in-five families live in poverty. A report by the University of Florida estimates the Foley mill closure will lead to the loss of approximately 2,000 jobs in total, including the truckers and loggers who supply the mill with slash pine.

And now Florida might hand a farewell tax break to the fleeing company — which is part of Koch Industries, the global conglomerate led by billionaire Republican donor Charles Koch.

The potential tax break for Koch Industries is included in a roughly $420 million hurricane aid package that Florida’s Republican-controlled state Legislature is expected to approve this week, during a four-day special session in Tallahassee.

The quick session was called primarily to express support for Israel in its war against Hamas — and to prop up Gov. Ron DeSantis’ sagging presidential campaign. But legislative leaders have also tacked a few other items onto the agenda, too, including hurricane relief.

The aid package was pulled together largely in response to Hurricane Idalia, the Category 3 storm that came ashore Aug. 30 in Florida’s “Big Bend” — the Gulf Coast corner of the state where the Panhandle meets the Peninsula. It includes an assortment of grants and tax breaks, many of which are aimed at supporting the rural region’s timber and aquaculture industries.

The biggest tax break in the bill would slash the property-tax appraisals for businesses that own agricultural machinery and equipment rendered inoperable by Idalia.

The tax break covers machinery owned by an “agricultural processing facility.” And that apparently includes the machinery at the Foley mill, which is located just 20 miles north of where Idalia made landfall.

That’s according to a group of state economists who analyzed the proposed tax break last week. “I don’t think there’s anything [in the legislation] that would exclude them,” Amy Baker, the head of the state’s Office of Economic & Demographic Research, said during the Friday meeting.

It's not clear how much Koch could save from the tax break, which applies to any equipment that was unable to be used for at least 60 days after Idalia stuck.

But it’s potentially a lot.

The Foley mill is operated by Georgia-Pacific, a Koch Industries subsidiary that had been using the facility to make specialty pulp used in everything from toothpaste and sausage casings to flat-screen televisions and high-performance air filters. And tax records show that Georgia-Pacific owns roughly $480 million worth of taxable machinery and equipment at the mill — on which it owes nearly $7 million in property taxes this year.

Hurricane Idalia impacted some of that equipment, according to a recent report by WCTV, a local television station (though Georgia-Pacific also said it made the decision to close the Foley mill before Idalia hit.)

The goodbye gift to Koch isn’t the only potentially hard-to-swallow subsidy in the Florida Legislature’s Idalia response package.

The legislation includes more support for the timber industry, including tax refunds on fuel purchased to ship agricultural products, like logs, and to remove storm debris from agricultural properties, like timber farms. It also includes $37.5 million in grants to help timber companies remove damaged trees and replant new ones.

This makes sense: Timber is the main industry in Taylor County, which calls itself the “Tree Capital of the South.” And the industry sustained heavy losses during Idalia, which damaged nearly 290,000 acres of timber with a combined value of nearly $65 million, according to the Florida Department of Agriculture and Consumer Services.

The problem is that most of the timberland in this particular area is owned by one person: Billionaire investor Thomas Peterffy, one of the 100 wealthiest people in the world, according to Forbes.

It’s not much of an exaggeration to say that Peterffy owns Florida’s Big Bend. He purchased more than 500,000 acres in the region about eight years ago — an enormous tract of land that was believed the largest contiguous piece of undeveloped property in private hands east of the Mississippi River.

Property records show that Peterffy owns about 380,000 acres in Taylor County alone, through his company, Four Rivers Land & Timber. That’s more than half the land in the entire county. And virtually all of it is in timber production.

And while there’s little doubt that Peterffy’s timber lands were hit hard by Hurricane Idalia, a land baron worth an estimated $25.3 billion probably doesn’t need help from taxpayers to deal with it.

To be clear: I’m not suggesting that Florida lawmakers drew up these tax breaks specifically to help Koch Industries or Thomas Peterffy — both of whom have been big donors to DeSantis during his time as governor.

To the contrary, much of this Hurricane Idalia relief package — including the property and fuel tax breaks — is simply copied from similar legislation lawmakers passed after Hurricane Michael hit the Panhandle in 2018.

But it does illustrate one of the downsides to using tax breaks to deliver aid: It can be difficult to truly target the support in a way that doesn’t end up sending a bunch of money to people you’d probably rather not help or to folks who really don’t need it. This was the big problem with the federal corporate tax breaks that former President Donald Trump and Congress rushed out the door early on in the COVID-19 pandemic.

It's also worth contrasting how loose Republican leaders in Tallahassee tend to be when it comes to tax breaks for businesses with all the restrictions, obstacles and outright barriers they impose on direct support for real people — whether that’s unemployment compensation, food stamps, or health insurance.

Thank you for once again shining a light on the lack of regard for ordinary tax payers in this state. Our voice is not even noted among those that need to be heard if you can’t provide a large check with it. Disheartening to be invisible to those that could change the way of life here for so many citizens. Your continued insights are much needed.

It’s a vampire oligarchy economy of robber barons utilising its sycophantic GOP, who in reality and behaviour are not much more than common prostitutes, to suck dry and feed on citizens. Thanks Jason for being a voice for the people once again.