Ron DeSantis may try to make it harder for immigrants to send money from Florida

An email obtained in a public-records request suggests the office of Gov. Ron DeSantis has explored new state restrictions on remittances.

This is Seeking Rents, a newsletter and podcast devoted to producing original journalism — and lifting up the journalism of others — that examines the many ways that businesses influence public policy across Florida, written by Jason Garcia. Seeking Rents is free to all. But please consider a voluntary paid subscription, if you can afford one, to help support our work.

Florida lawmakers had barely begun this year’s legislative session, and Sen. Ileana Garcia was already under pressure.

Garcia, a Republican from Miami, had just voted in favor of a polarizing piece of legislation that was meant to make it much harder for undocumented immigrants to live and work in Florida. The bill (Senate Bill 1718) was a top priority of Gov. Ron DeSantis, who was about to run for president. But it outraged immigrant advocates, who were planning a protest outside Garcia’s office near Coral Gables.

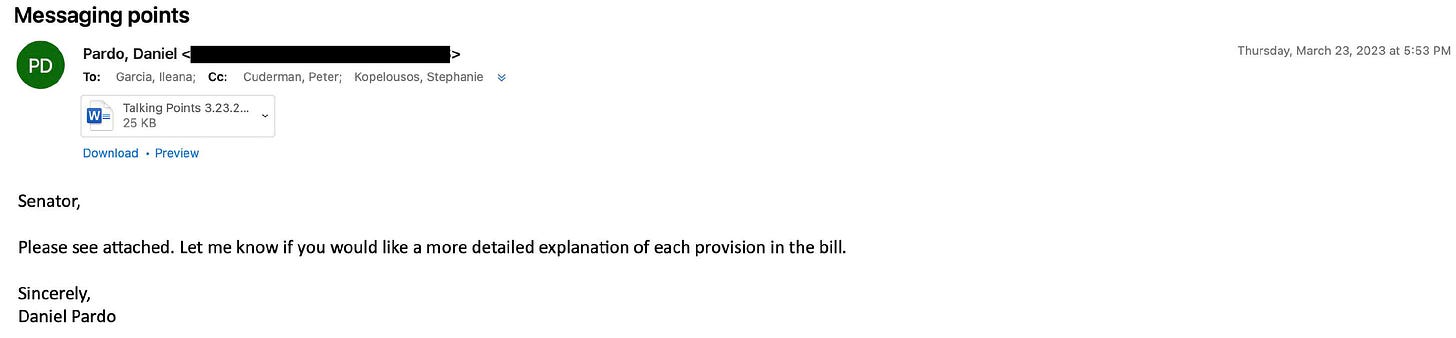

So the Governor’s Office tried to help. On March 23 — the same day as the planned protest — records show that an aide to the governor sent Garcia a one-page document explaining and defending the DeSantis’ immigration proposal, according to an email Seeking Rents obtained through a public-records request.

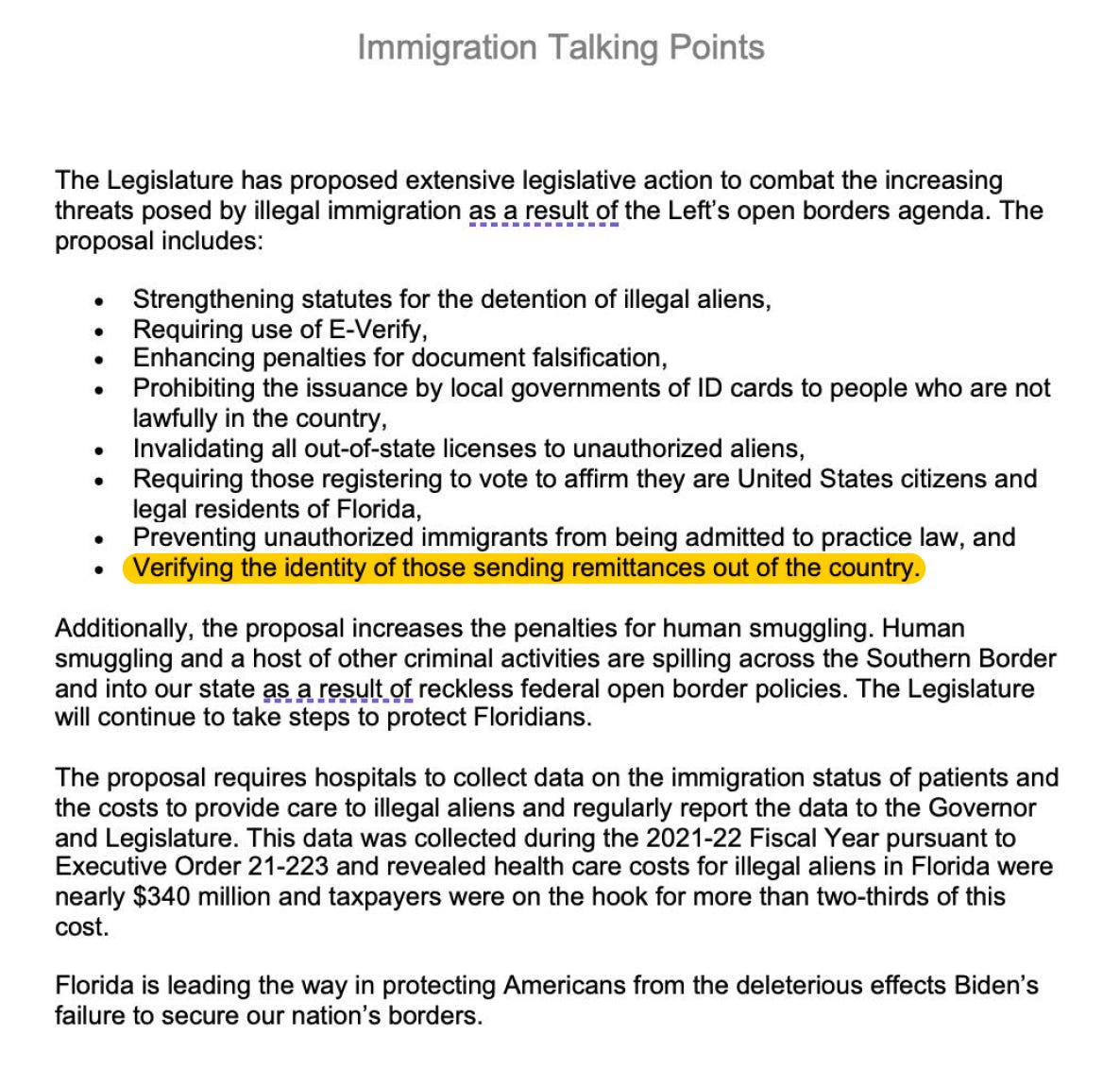

Among other things, the summary sent by the Governor’s Office noted that the legislation would impose new rules on people in Florida who want to send money to family members in other parts of the world — monetary transfers known as “remittances” that are frequently made by migrants and foreign immigrants through services like Western Union and PayPal.

“The proposal includes…verifying the identity of those sending remittances out of the country,” the Governor’s Office wrote.

There’s just one catch: That’s not an idea that ever appeared in Senate Bill 1718. Nor did the idea appear in DeSantis’ original immigration proposal.

It stands out because everything else in the summary the Governor’s Office sent to Garcia lines up almost exactly with the legislation as it stood at the time.

The Governor’s office declined to explain the discrepancy. Neither the DeSantis staffer who sent the summary — Daniel Pardo, a deputy director for policy — nor spokespeople in the Governor’s Press Office would answer questions about it.

Garcia did not respond to a request for comment, either.

But the document suggests that the DeSantis administration was, at least internally, exploring a potential crackdown on remittances at some point this past session.

And that would also mean it’s an idea that Ron DeSantis could resurrect again a few months from now — especially if he decides that pushing more hardline immigration legislation in Florida could help him attract more attention from Republican primary voters in other states.

The Florida Legislature will gavel open its 2024 session on Jan. 9. That’s just six days before Iowa conducts the first contest of the 2024 presidential election — a state where DeSantis has pinned nearly all his presidential hopes.

We’ve seen something like this before.

Last year, for instance, records requests filed by Seeking Rents and other organizations revealed a series of proposals that the DeSantis administration had drafted ahead of Florida’s 2022 legislative session — including bills giving the governor more power over state universities and weakening legal protections for news organizations.

DeSantis opted not to pursue those ideas then. But he did a year later, during this year’s legislative session.

And the Florida governor clearly has remittances in his crosshairs. He recently called for a new national tax on remittances sent by undocumented people working in the United States.

But any attempt to interfere with people sending aid to their families in other countries could cause serious complications in Florida, a state that is home to more than 4.5 million immigrants — including roughly 1.8 million non-citizen immigrants.

The United States is the world’s largest source of remittances, sending an estimated $72.7 billion last year to developing countries. And several billion dollars a year, at least, comes from folks working in Florida.

While state-specific totals can be hard to find, one relatively recent study found that workers in Florida sent $1.15 billion annually to Mexico. People in Florida are also the largest source of remittances to Cuba. And they are almost certainly a major source of private aid to other Latin American countries — including Guatemala, the Dominican Republic, El Salvador and Honduras, all of which receive more than $5 billion a year in remittances from the U.S.

And while some anti-immigration activists often attack remittances, they actually boost the economies of both the U.S. and the recipient countries, according to David R. Henderson, a research fellow at the Hoover Institute, a conservative think tank. “They are a large, voluntary, and effective form of foreign aid,” Henderson writes.

Experts in Florida say that erecting more hurdles to remittances in Florida — such as imposing additional ID requirements — might scare some workers from sending remittances at all or sending the money through less secure, unofficial channels.

“It’s an intimidation tactic,” said Guillermo Grenier, a professor of sociology in the Department of Global and Sociocultural Studies at Florida International University.

It could also drive up the cost of sending remittances. That would be a particular problem for Cuban-Americans; sending money from the U.S. to Cuba is the most expensive remittance corridor in the world, according to the World Bank.

“I think it would be very problematic in any way that you make it more difficult for people [and] to have this additional layer of bureaucracy to get through….for someone who may just be trying to send aid to their family,” said Ana Sofía Peláez, a co-founder of the Miami Freedom Project.

Ultimately, any additional state burdens placed on remittances would simply make life in Florida for difficult for immigrants, especially undocumented folks.

Which, of course, was also the point of SB 1718.

Among other things, the final version of DeSantis’ immigration legislation — which is being challenged in court — cuts off funding to Florida organizations that provide IDs to undocumented people and invalidates driver’s licenses issued by other states. It makes hospitals collect information about immigration status. And it increases penalties for businesses that employ undocumented workers.

The new law will even prevent undocumented students who have earned a law degree from a Florida university from taking the state Bar exam.

Now, it’s worth noting here that even some Republican lawmakers who voted for the bill have since criticized the new law — which has already contributed to apparent labor shortages in agriculture and construction.

But it’s also worth noting that, as draconian as opponents say DeSantis’ new immigration law is, the governor didn’t get everything he wanted from Florida lawmakers this year.

Most notably, DeSantis also wanted to raise the cost of university tuition for children of undocumented immigrants. But the Legislature refused to go along with that idea.

Between that unfinished business and a sagging presidential campaign, it seems like a good bet that DeSantis will pick another immigration fight in Florida soon. And an attack on remittances might be part of it.

So much for DeSantis proclaiming to be a Christian. Instead of uniting Biblically in love thy neighbor or love thy enemy, all he does is hate and divide, which is Satanic. He and his ilk are the proverbial wolves in sheep’s clothing Christ warned people about.

I wish to expand on my earlier post on Postal Banking and how it could help immigrants, the unbanked and working people.

Postal banking services

The USPS already offers some very limited financial products, including the sale of money orders, international money transfers to nine countries, and cashing of U.S. Treasury checks. Adding more will help contrast the everlasting list of exorbitantly-priced financial services. The Postmaster General can take action under the Postal Service’s existing authority to offer more basic banking services, including:

Low-cost ATMs with free access for Treasury Direct Express cards, providing Social Security benefits at no cost;

Electronic money transfers to other U.S. post offices and more foreign countries

Cashing paychecks; and

Bill payment services, allowing the unbanked to make fast, convenient payments for utilities and other essential services.

Pilot projects could explore additional products.