Ron DeSantis' top aide punished bank lobbyists for being disloyal

A window into how the highest levels of Ron DeSantis' office think and act.

This is Seeking Rents, a newsletter and podcast devoted to producing original journalism — and lifting up the journalism of others — that examines the many ways that businesses influence public policy across Florida, written by Jason Garcia. Seeking Rents is free to all. But please consider a voluntary paid subscription, if you can afford one, to help support our work.

Every now and then while poking through public records, I happen across something that strikes me as particularly revealing about some of the most powerful people in Florida government.

Like an email in which Gov. Ron DeSantis’ top aide behaves like an imperious fanatic who wields access to the Governor’s Office like a weapon.

An email in which DeSantis’ chief of staff and former presidential campaign manager accuses a bunch of bank lobbyists of being un-American and insufficiently loyal in a supposed war against “Marxist” forces — all while trying to do a favor for a client of one of DeSantis’ most important political fundraisers.

Allow me a moment to explain, because the backstory is a bit complicated.

It involves a trio of banking industry issues. They are:

House Bill 3: This was a controversial bill that DeSantis pushed through the Florida Legislature last year, as he was preparing to run for president. The new law is designed to eliminate the use of environmental, social and governance (ESG) factors in investing. Part of the bill threatened sanctions against banks and credit unions that refuse to lend to certain types of businesses — like producers of fossil fuels or operators of for-profit prisons.

Public deposits: Public deposits are basically the bank accounts for state and local governments across Florida, and they have been the subject of a long-running lobbying battle between banks and credit unions. That’s because banks have historically been the only institutions permitted to hold public deposits in Florida — and banks want to keep it that way. But credit unions want the rules changed so that they can hold public deposits, too.

Credit union taxes: Credit unions, which are not-for-profit, are exempt from most state taxes. That’s been another longstanding source of industry tension. Banks want credit unions to pay the same taxes they do, arguing that the current situation gives credit unions an unfair competitive advantage. Credit unions, of course, want to maintain that advantage.

So what do House Bill 3, public deposits, and credit union taxes have to do with each other?

Well, it starts with the fact that one of DeSantis’ goals during this year’s legislative session, which ran from January to March, was to expand House Bill 3.

This is an important issue to the Republican governor, who wants to run for president again one day. The crusade against ESG-based investing is part of a larger war on all things deemed by the right to be “woke,” which has become a core part of DeSantis’ political identity. (The hostility to ESG investing is also important to some national conservative megadonors who might bankroll a future presidential run.)

But expanding House Bill 3 faced potential opposition from banks and credit unions. And they are both influential lobbies in the Florida Legislature — while DeSantis himself has become a diminished figure in Tallahassee following his sometimes-humiliating defeat to Donald Trump during the 2024 GOP presidential primary.

So DeSantis tried to negotiate a deal with the bank and credit union lobbies, according to a series of emails obtained in post-session public-records requests.

Now, these emails don’t spell out precisely how it all went down in exact detail. But they suggest that the credit unions were willing to get on board if DeSantis and the Legislature also gave them a cut of the action on public deposits.

DeSantis agreed to that. But then the banks responded that they would not sign on unless the governor and lawmakers also eliminated the credit unions’ tax advantages.

DeSantis refused to deal with that — perhaps because the once-and-future presidential candidate knew he would be accused of raising taxes.

But the bank lobbyists would not back down.

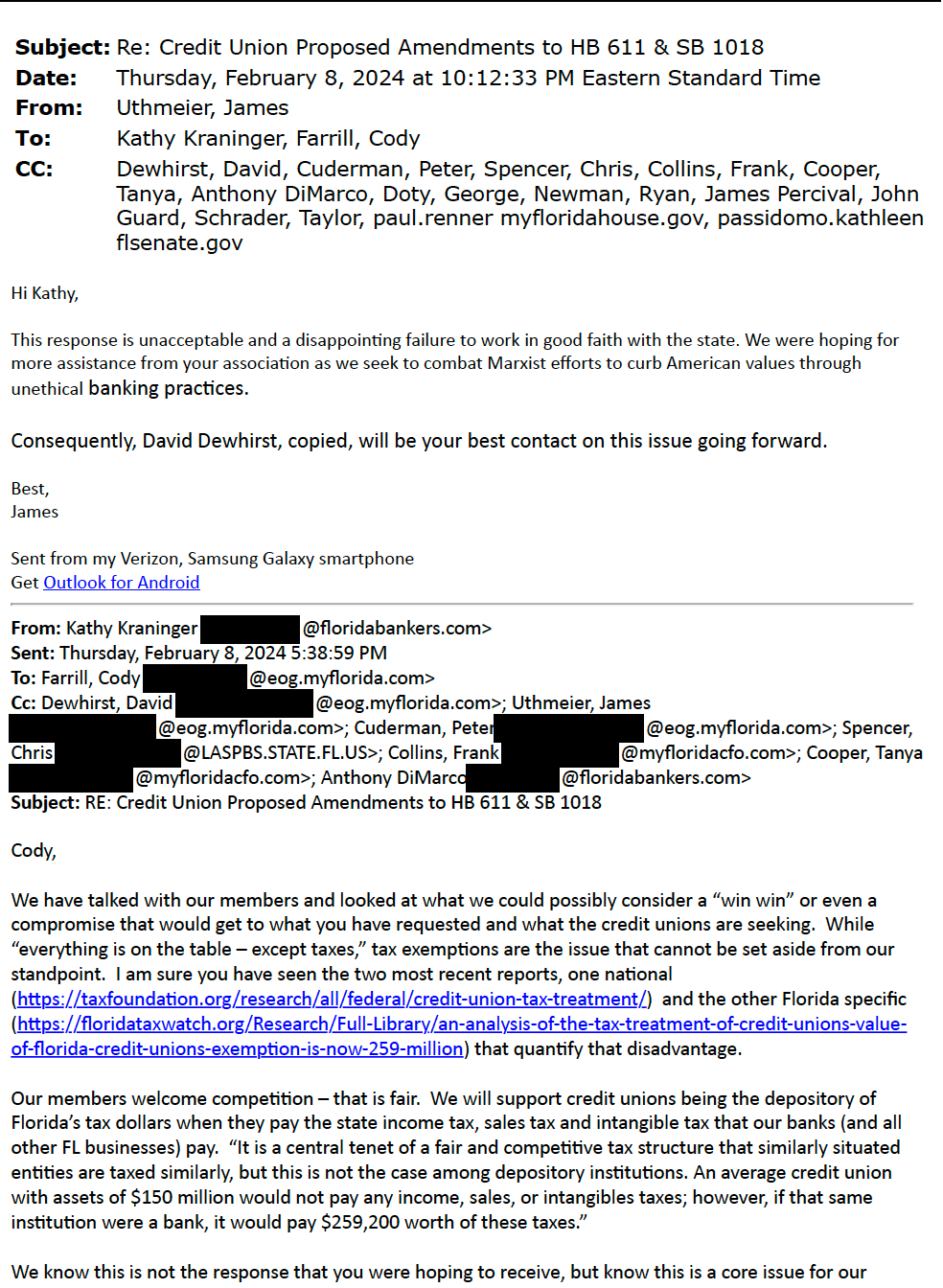

“We have talked with our members and looked at what we could possibly consider a ‘win win’ or even a compromise that would get to what you have requested and what the credit unions are seeking,” Kathy Kraninger, the president and CEO of the Florida Bankers Association, wrote in a mid-session email to senior staffers to DeSantis and Republican Chief Financial Officer Jimmy Patronis.

“While ‘everything is on the table — except taxes,’ tax exemptions are the issue that cannot be set aside from our standpoint,” she added. “We know this is not the response you were hoping to receive, but know this is a core issue for our members and for us.”

That response apparently enraged James Uthmeier, who had recently resumed his as role as DeSantis’ chief of staff after managing the Florida governor’s failed presidential campaign.

That night, the governor’s most powerful aide blasted off a startling note that accused the banking association of being disloyal and un-American — and cut off their access to the top of DeSantis’ office.

“This response is unacceptable and a disappointing failure to work in good faith with the state,” Uthmeier wrote in an email sent at 10:12 pm. “We were hoping for more assistance from your association as we seek to combat Marxist efforts to curb American values through unethical banking practices.”

Uthmeier ended by ordering the bank lobbyists to work through a subordinate aide going forward.

The response seemed designed to humiliate the banking association CEO. Uthmeier copied nearly half a dozen additional people on his response — including the speaker of the House of Representatives, the president of the Florida Senate, and the chief of staff to the Attorney General.

Read the full thread here:

From that point on, DeSantis seems to have gone all in on helping the credit unions.

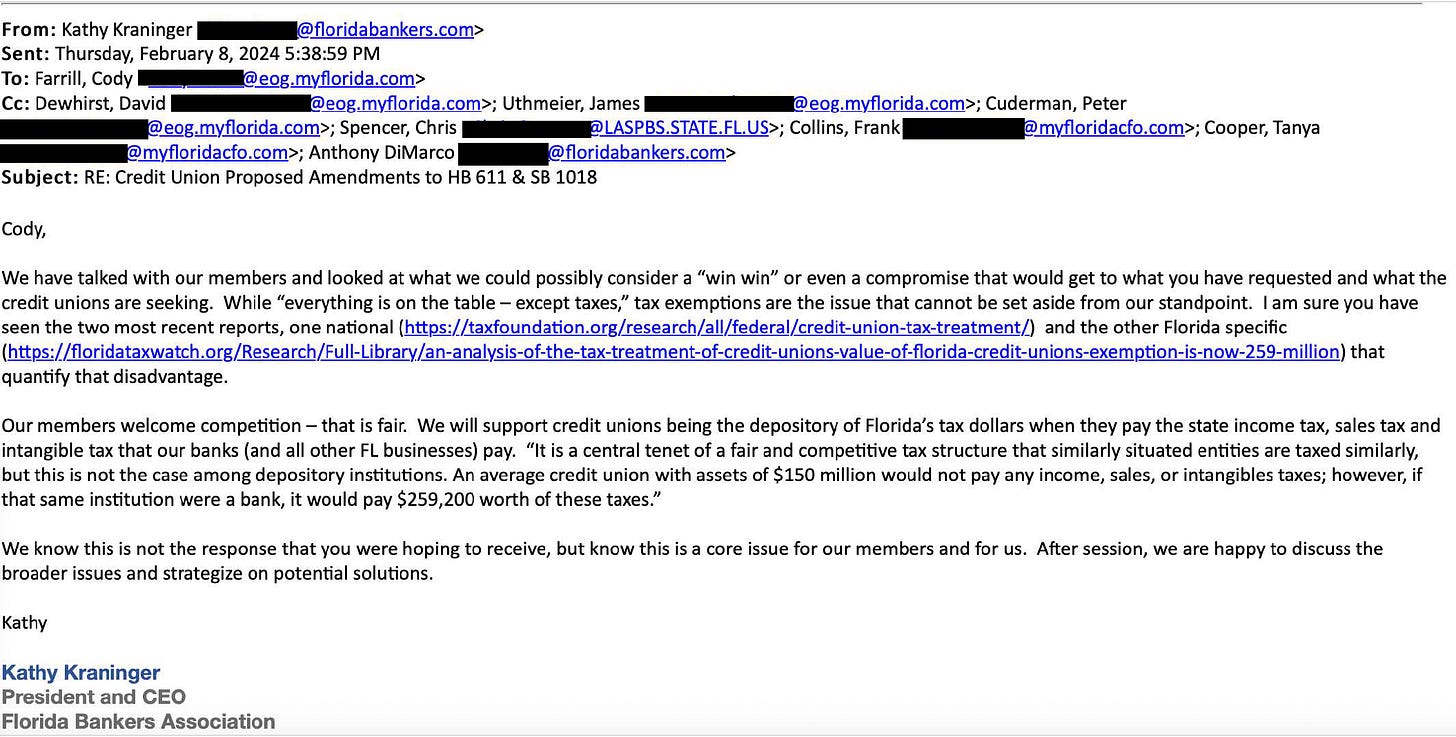

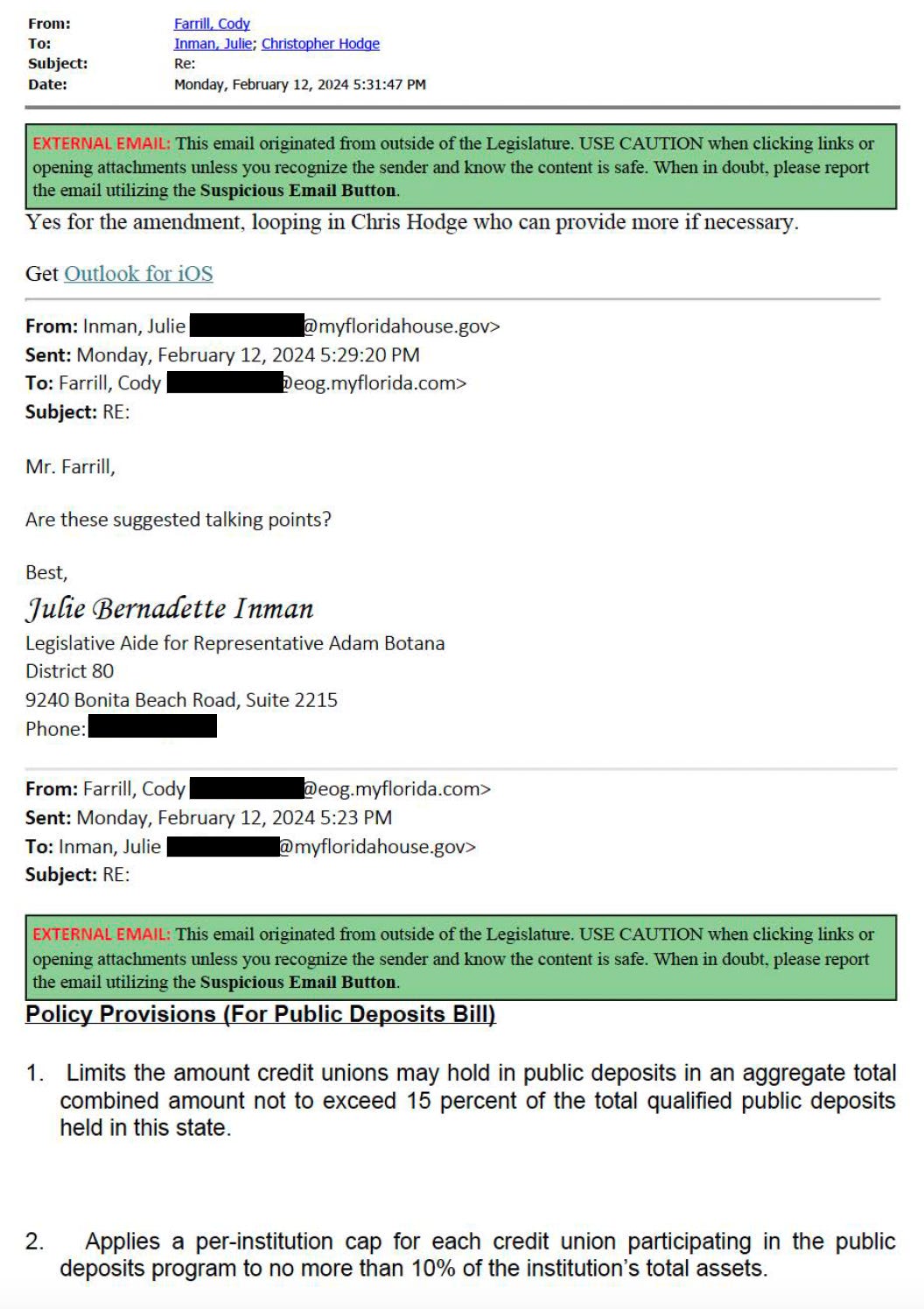

Subsequent emails show that DeSantis aides personally pushed Florida lawmakers to approve legislation allowing credit unions to hold public deposits. A deputy chief of staff in the Governor’s Office passed along proposed amendments for lawmakers to file, gave them them talking points to read in public, and connected them directly to credit union lobbyists.

It worked: On the second-to-last day of this year’s legislative session, the Florida House of Representatives attached an amendment to a bill dealing with financial regulation that made credit unions eligible for the state’s public deposits program. The amendment squeaked by on a chaotic, 49-45 vote — one of the closest votes of the entire session.

Right around the same time, lawmakers also attached another last-minute provision to the same bill (House Bill 989) that expanded House Bill 3. That provision gives customers a way to lodge complaints and trigger state investigations against banks or credit unions they suspect of violating that law.

It became one of the very last bills the Republican-controlled Florida Legislature passed this year. DeSantis has since signed it into law, hailing it as another example of Florida “stopping the woke.”

For what it’s worth, I personally think DeSantis and his team were on the right side of this issue. (In terms of allowing credit unions to hold public deposits, I mean; not by expanding House Bill 3, which has always been a corporate favor masquerading as a culture war.)

There is a lot of money sitting in public deposit accounts — nearly $40 billion, according to the state’s Bureau of Collateral Management. That money ultimately belongs to the taxpayers of Florida. Credit unions should absolutely be allowed to compete with banks for their business.

The competition could lead to lower interest rates for taxpayers. Even if it doesn’t, there’s simply no good reason to wall this business off just for banks — which helps a national giant like Wells Fargo hoard more than $5 billion all by itself.

That said, it’s also worth noting that the main credit union association in Florida — the League of Southeastern Credit Unions — hired Capital City Consulting, a Tallahassee lobbying firm whose owner helped lead the national fundraising for DeSantis’ presidential campaign. The emails show that DeSantis’ staff worked directly with Capital City lobbyists on the public deposits legislation (and on other issues from this past session, too).

In addition, despite Uthmeier’s histrionics, the emails also show the Governor’s Office continued trying to help the banks. For instance, DeSantis’ staff pitched several potential tax breaks for banks to the Legislature during the closing days of session, although lawmakers ultimately opted not to pass any of them.

And then there’s the fact that DeSantis ended this year’s session by giving a giant gift to the banks and credit unions both — when the governor stepped in to stop a study meant to identify ways Florida could prevent credit-card companies from collecting swipe fees on sales taxes.

Those fees — which the credit-card companies split with banks and credit unions — cost Florida stores, restaurants and tourism businesses nearly $300 million a year. That’s according to retail industry lobbyists, who have been lobbying to end the practice.

Florida lawmakers put money into this year’s budget to pay for a public study of the issue. But DeSantis vetoed it.

The banks and credit unions have both lobbied to preserve the status quo. So has Visa — which happens to be another Capital City client.

And don’t forget - the credit unions got slammed with jail time for the S&L scandal (actually went to jail) for scamming all of us. Accounting control frauds, liar's loans, appraisal fraud. It's all documented. The 300 worst went to trial (there was more) and they had a 90% conviction rate.

The bankers should all be in jail anyway. The Best Way to Rob a Bank is to Own One. William Bill Black, PhD, lawyer, and former bank regulator

He’s a petty, vindictive little man with a god complex. Keep the receipts cause he plans on running again in the future.