Visa and Mastercard are lobbying for inflated credit card fees in Florida

The duopoly that controls the American credit card market has been profiting off tax collection in Florida. It doesn't want to stop.

This is Seeking Rents, a newsletter and podcast devoted to producing original journalism — and lifting up the journalism of others — that examines the many ways that businesses influence public policy across Florida, written by Jason Garcia. Seeking Rents is free to all. But please consider a voluntary paid subscription, if you can afford one, to help support our work.

Earlier this month, just a bit before Christmas, the country’s two biggest credit card companies sprinkled tens of thousands of dollars on a handful of key lawmakers in Florida.

It began on Dec. 4, when Mastercard Inc. and one of its executives delivered at least $20,000 to a trio of top Republicans in the Florida Senate — including a $10,000 gift for Senate President Kathleen Passidomo (R-Naples).

The next week, Visa Inc. followed up with at least $20,000 for a few Republicans in the state House of Representatives — including $10,000 for House Speaker Paul Renner (R-Palm Coast).

And in between, the Electronic Payments Coalition — which represents both Visa and Mastercard — handed out at least $25,000 more.

You could almost think of these donations as early Christmas presents from the companies that rule the American credit card market to the politicians that rule Tallahassee. But these gifts come with strings: Because Visa and Mastercard are simultaneously lobbying the Florida Legislature for the right to continue charging inflated credit card processing fees.

The issue involves the so-called “swipe fees” that stores and restaurants pay whenever a customer buys something with a credit or debit card. The average fee, which is set by card processors like Visa and Mastercard, is around 2.24 percent, according to the National Retail Federation. A restaurant owner in Tampa recently wrote in the Tampa Bay Times that his average swipe fees range from 3 percent to 3.5 percent. (Swipe fees on debit cards, which are more tightly regulated by the federal government, are much lower.)

In theory, it’s all fairly straightforward. Say you buy $100 worth of taxable stuff with a Visa at a store that’s obligated to pay a 3 percent swipe fee. The store would pay $3 in fees, which are ultimately split between Visa and the banks that it works with issuing cards and processing transactions.

Except Visa also charges that swipe fee on the sales tax, too. So say you make that $100 purchase in a Florida county with a 7 percent sales tax, and charge $107 total to your Visa. The store will end up paying $3.21 in swipe fees — allowing Visa and the banks to pocket an extra 21 cents.

It’s a marginal increase. But it adds up: Stores in Florida paid an estimated $288.2 million on swipe fees charged on sales taxes during the state’s 2021-22 fiscal year, according to the Florida Retail Federation and the Florida Restaurant & Lodging Association, lobbying groups that represent retail, restaurant and tourism businesses.

These lobbying groups want to put a stop to it. More specifically, they are lobbying the Florida Legislature to prohibit credit card companies from collecting swipe fees on sales taxes.

The battle to eliminate swipe fees on sales taxes has become major special-interest showdown in Tallahassee — a kind of Godzilla vs. King Kong clash, pitting retailers like Walmart, Outback Steakhouse and Universal Studios against Visa and Mastercard, plus all the banks and credit unions that issue their cards.

Both sides have been pulling all the lobbying levers, from showering Florida politicians in campaign cash to commissioning sympathetic commentary from pliable Tallahassee think tanks like Florida TaxWatch (which sides with the retail lobby) and the James Madison Institute (which is on team credit card).

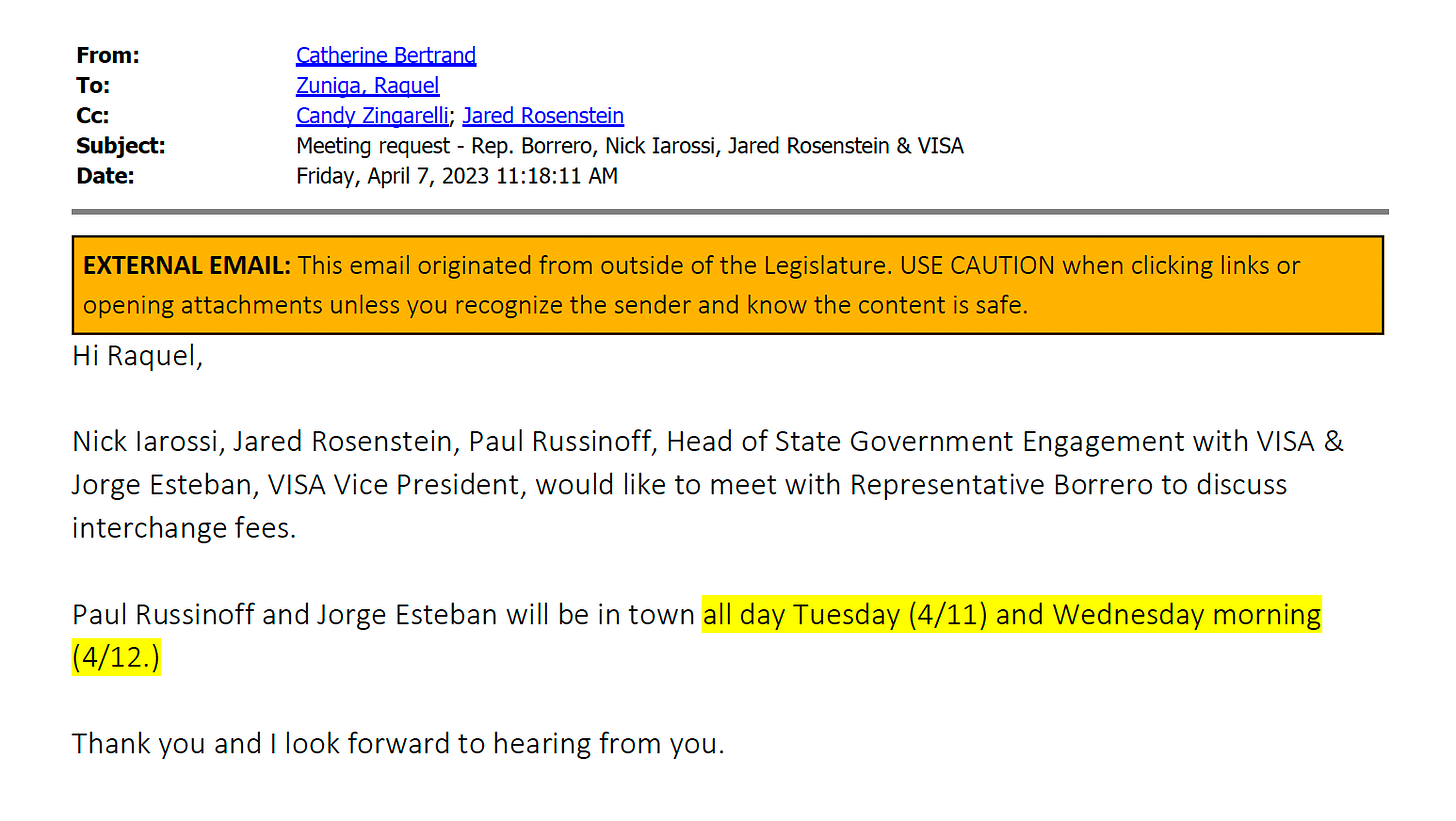

At one point during the Legislature’s last legislative session, the Florida lobbyist Nick Iarossi — who doubles as a fundraiser for Gov. Ron DeSantis — escorted a pair of Visa executives around the state Capitol. In one-on-one meetings, those Visa executives urged lawmakers to vote against bills that would have eliminated swipe fees on sales taxes (House Bill 677 and Senate Bill 564).

The retail, restaurant and tourism lobbies have lost this fight so far. Leaders in the House and Senate — the same folks cashing Visa and Mastercard checks just before Christmas — declined to bring the bills up for full floor votes. But both sides are gearing up for round two of the fight during Florida’s next legislative session, which begins Jan. 9.

On one hand, there’s a satisfying feeling to watching the likes of Walmart, Outback and Universal lose a lobbying battle. The retail, restaurant and tourism lobbies are some of most truly awful actors in Tallahassee, annually pressing state lawmakers and governors to pass bills that harm workers, consumers and small businesses.

They have successfully lobbied in the past to deny sick-time benefits to employees, to block unemployment payments to laid-off Floridians, to keep loopholes in Florida’s corporate tax, and to exploit anti-poverty programs.

These same retailers are right now lobbying to preserve their right to jerk hourly workers around with erratic schedules and unpredictable hours, to make high-school kids work overnight shifts and 40-hour workweeks, and to stuff state prisons with non-violent shoplifters.

But as monstrous as businesses like Walmart and Universal may be on so many other issues, they are right on this one. Nobody should be profiting off tax collection — which is exactly what Visa, Mastercard and their banks are doing when they collect swipe fees on sales taxes

The credit card companies and their banking industry allies have thrown up all sorts of objections. Reprogramming electronic-payment systems will be expensive, particularly for smaller businesses that may have to upgrade point-of-sale devices. And the vast majority of swipe-fee savings would go to corporate titans like Walmart; your favorite local pub or neighborhood boutique would save pennies in comparison.

There is some truth to these claims. But they are also easily addressed. For instance, one version of last year’s legislation included a provision ordering the state’s Office of Economic and Demographic Research to evaluate the fallout from eliminating swipe fees on sales taxes — including the financial and technical impacts on all the businesses involved, from the merchants to the credit card processors to the banks.

That would be an important step. For one thing, we would all benefit from more public, independent research on credit card fees, rather than relying on industry propaganda laundered through groups like TaxWatch or the James Madison Institute. And for another, if that public research identifies any problematic consequences from eliminating swipe fees on sales taxes, Florida lawmakers can address them at that point. The Florida Legislature meets every year, after all.

But Visa and Mastercard’s sky-will-fall hysteria is almost certainly exaggerated, too. It’s worth noting that the credit card and banking lobbies are using many of the exact same talking points and scare tactics to fight federal credit card reform in Congress — bipartisan legislation that would force Visa and Mastercard to face some genuine competition.

In truth, this battle is — like every other tax fight in Tallahassee — about one thing, and one thing only: Money. The credit card companies and banks simply don’t want to lose the $300 million a year they collect in Florida by charging swipe fees on sales taxes.

Frankly, I’d rather stores and restaurants keep that money than give it to Visa and Mastercard — a duopoly that controls more than 80 percent of the credit cards in the United States and uses that market dominance to squeeze outsized profits out of the rest of us.

What do I mean by outsized profits? Well consider this: In its most recent fiscal year, Visa generated $32.7 billion in sales, from which it pocketed $17.3 billion as profit. That’s a profit margin of more than 50 percent.

Walmart, by comparison, generated far more than Visa in sales: About $610 billion. But the world’s largest retailer actually ended up with a much smaller profit than the credit card company: $11.3 billion. That’s a profit margin of less than 2 percent.

Then there’s this detail, which comes from The Economist: If you rank every company in the S&P 500 (excluding real-estate investment trusts) by profit margin last year, five years ago, and 10 years ago, there are four firms that turn up in the top 20 every single time. Two of them are Visa and Mastercard.

Now, if Florida lawmakers really do eliminate swipe fees on sales taxes — and let retailers keep that $300 million a year they are currently sending to credit card companies and banks — it would be nice if they also made stores and restaurants pass at least some of those savings on to consumers, too.

Alas, this is Republican-controlled Tallahassee, where most lawmakers seem to care far more about helping businesses than they do about helping consumers or workers. So any pass-through provision is probably out of the question, leaving retailers free to keep that $300 million for themselves.

But at least there’s a lot more competition in the retail business than there is in the credit card industry — so there’s a chance that some amount of the savings will ultimately flow through to consumers in the form of lower prices.

And even if that doesn’t happen, there’s another reason you should care about this debate: It might cost you if you don’t.

Here’s what I mean: In its pro-retailer report urging Florida lawmakers to eliminate swipe fees on sales taxes, Florida TaxWatch also floated an alternative option — having the state itself reimburse stores and restaurants for those fees.

The same thought has occurred to the other side, too: A recent pro-credit card report urging lawmakers to keep swipe fees on sales taxes also suggested they solve the issue by having states reimburse retailers instead.

So under that potential “solution,” Florida retailers would still give $300 million a year to the credit card companies and their banks. But then Florida taxpayers would give $300 million to the retailers.

In other words, it would fall to taxpayers to continue subsidizing those fat Visa and Mastercard profit margins.

That’s why it’s important to pay attention as Visa and Walmart wrestle this out in Tallahassee.

Because while it might seem like just another big-business battle royal right now, it may only be a matter of time until Godzilla and King Kong stop fighting over each other’s lunch money — and team up to take yours instead.

Interesting reporting. One, I didn't even know that swipe fees were NOT inclusive of sales tax. I just assumed you paid the fee on the entire amount. If there is a way to get that nixxed, I'm willing to bet that the profits of such companies goes up by the amount that the profits of the credit card companies goes down. If Walmart is only working on a 2% margin, we already know they are doing it the tightest they can with their current cost structure. Credit card companies, on the other hand, if they are truly making a 50% profit are costing us all a lot of money.

I do agree with Gabby - cash would prevent all of this. However, the cash customer is paying the CC fees whether are not they are aware of it. It's built into the cost structure.

The fiat system in full display. Do you have suggestions in terms of fighting this? Other than “calling your representative”...because that never works.